Question: i have two hours to submit!! please help! The following accourting events apply to Mary's Designs for Year 1 : Asset Source Transactlons 1. Began

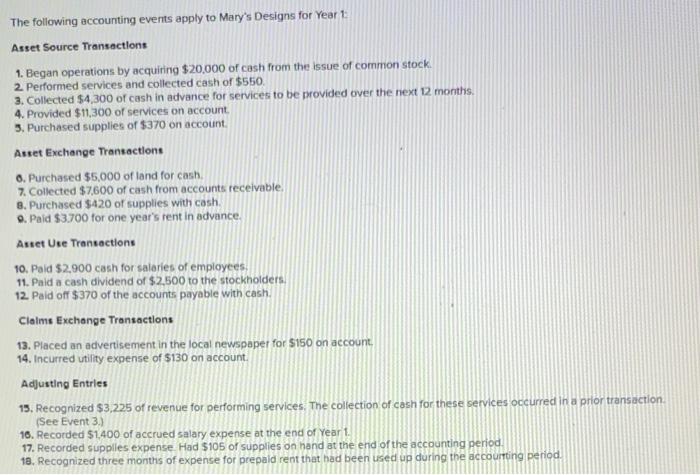

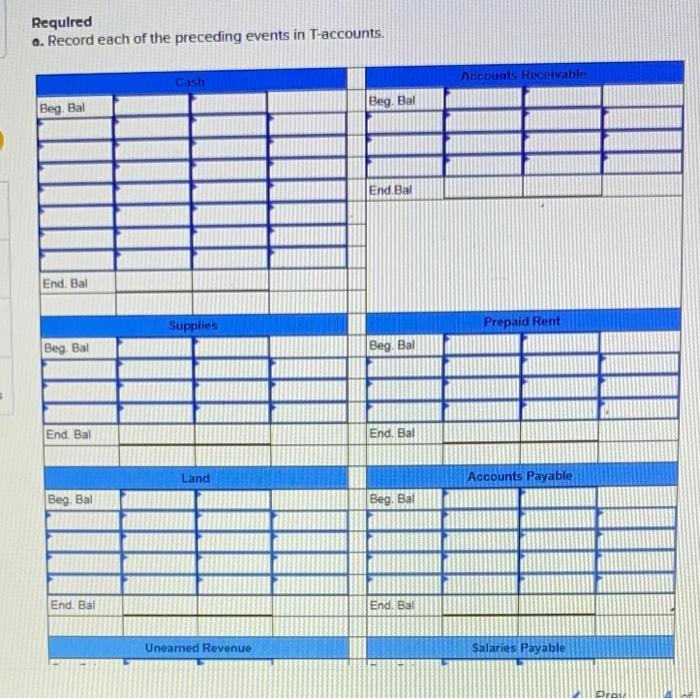

The following accourting events apply to Mary's Designs for Year 1 : Asset Source Transactlons 1. Began operations by acquiring $20.000 of cash from the issue of common stock. 2. Performed services and collected cash of $550. 3. Collected $4,300 of cash in advance for servicess to be provided over the next 12 months. 4. Provided $11,300 of services on account. 3. Purchased supplies of $370 on account. Asset Exchange Transactions 0. Purchased $5,000 of land for cash. 7. Collected $7,600 of cash from accounts receivable. 8. Purchased $420 of supplies with cash. 9. Paid $3700 for one year's rent in advance. Asset Use Transactions 10. Paid $2,900 cash for saleries of employees: 11. Paid a cash dividend of $2,500 to the stockholders. 12. Paid off $370 of the accounts payable with cash. Clalms Exchange Transactions 13. Placed an advertisement in the local newspapet for 5150 on account. 14. Incurred utility expense of $130 on account. Adjusting Entries 15. Recognized $3,225 of revenue for performing services. The collection of cash for these services occurred in a prior transaction. (See Event 3.) 10. Recorded $1.400 of accrued salary expense at the end of Year 1 . 17. Recorded supplies expense. Had $105 of supplies on hand at the end of the accounting period. 18. Recognized three months of expense for prepaid rent that had been used up during the accourting period. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts