Question: i have worked on this for a while but this is confusing. S Power Drive Corporation designs and produces a line of golf equipment and

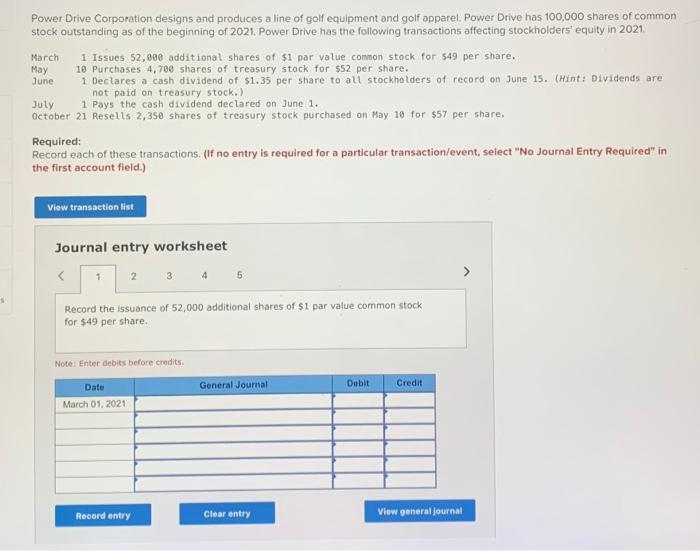

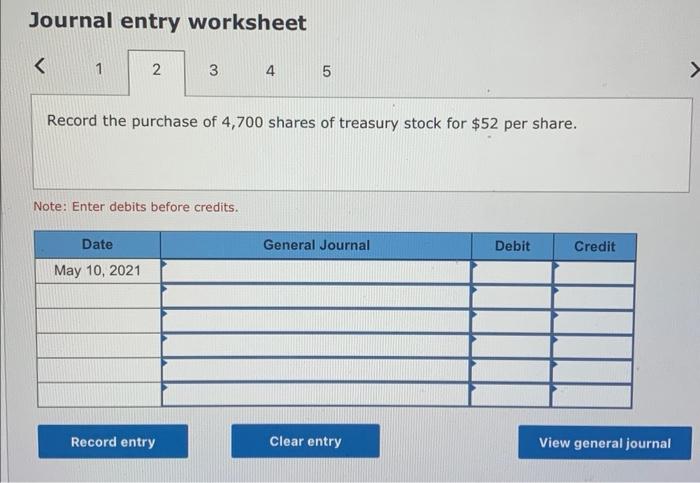

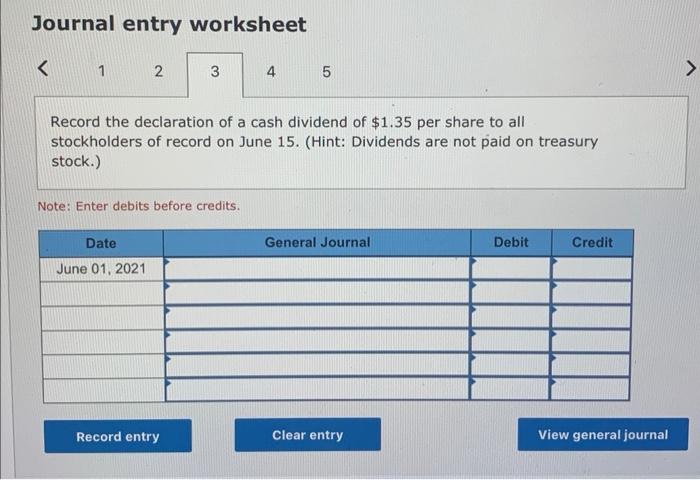

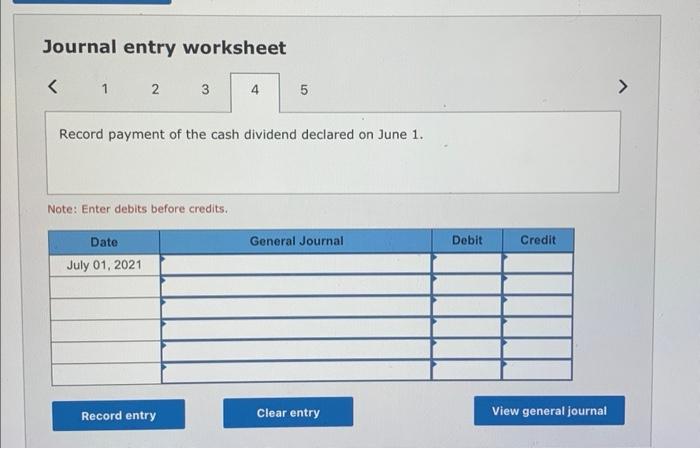

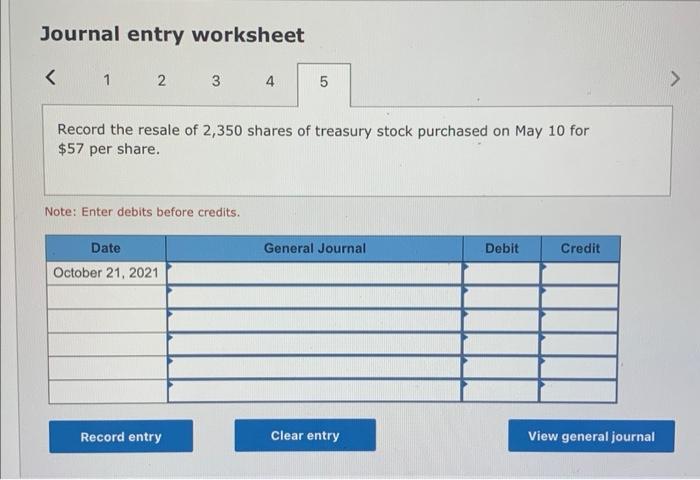

Power Drive Corporation designs and produces a line of golf equipment and golf apparel. Power Drive has 100,000 shares of common stock outstanding as of the beginning of 2021 . Power Drive has the following transactions affecting stockholders' equity in 2021. March 1 Issues 52,000 additional shares of $1 par vatue common stock for $49 per share. May 10 Purchases 4,700 shares of treasury stock for $52 per share. June 1 Declares a cash dividend of $1.35 per share to all stockhoiders of record on June 15. (Hint: Dividends are not paid on treasury stock, ) July 1 Pays the cash dividend declared on June 1. October 21 Resells 2,350 shares of treasury stock purchased on May 10 for $57 per share. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 5 Record the issuance of 52,000 additional shares of $1 par value common stock for $49 per share. Note: Enter debits before credits. Journal entry worksheet Record the purchase of 4,700 shares of treasury stock for $52 per share. Note: Enter debits before credits. Journal entry worksheet 1 5 Record the declaration of a cash dividend of $1.35 per share to all stockholders of record on June 15. (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet Record payment of the cash dividend declared on June 1. Note: Enter debits before credits. Journal entry worksheet Record the resale of 2,350 shares of treasury stock purchased on May 10 for $57 per share. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts