Question: ( i ) Help Save & Exit Submit Required information [ The following information applies to the questions displayed below. ] Lydex Company's financial

i

Help

Save & Exit

Submit

Required information

The following information applies to the questions displayed below.

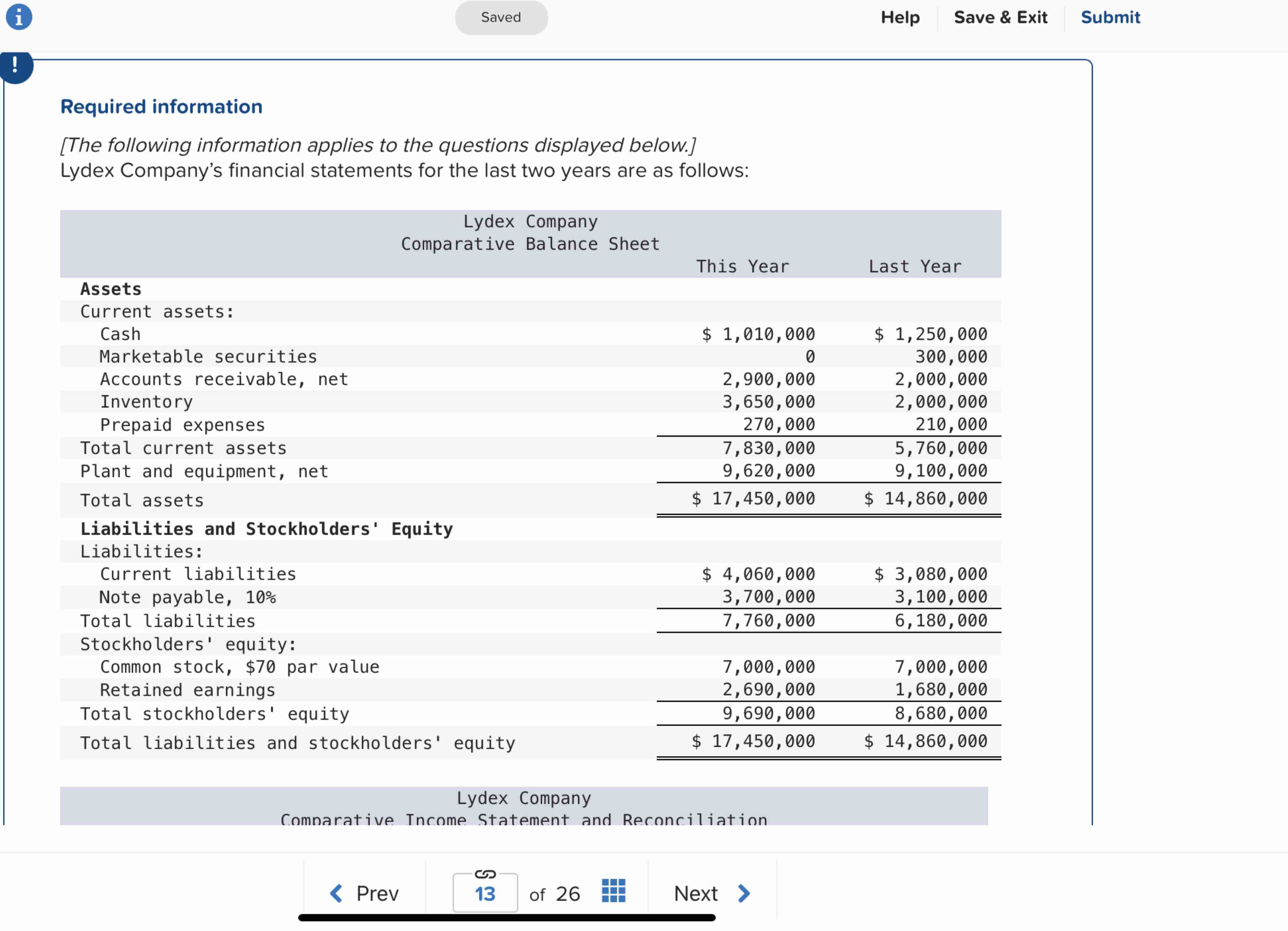

Lydex Company's financial statements for the last two years are as follows:

Lydex Company

Comnarative Income Statement and Reconciliation

of

Next Content

Question Home...

mathrmNmathrmT COLOR THE WORLD...

Hand Skin Doctor

Roku Signin

i

Help

Save & Exit

Submit

begintabularccc

hline begintabularl

Lydex Company

Comparative Income Statement and

endtabular & Reconciliation This Year & Last Year

hline Sales all on account & $ & $

hline Cost of goods sold & &

hline Gross margin & &

hline Selling and administrative expenses & &

hline Net operating income & &

hline Interest expense & &

hline Net income before taxes & &

hline Income taxes & &

hline Net income & &

hline Common dividends & &

hline Net income retained & &

hline Beginning retained earnings & &

hline Ending retained earnings & $ & $

hline

endtabular

The following financial data and ratios are typical of companies in Lydex Company's industry:

begintabularlc

Current ratio &

Acidtest ratio &

Average collection period & days

Average sale period & days

Return on assets &

Debttoequity ratio &

Times interest earned ratio &

Priceearnings ratio &

endtabular

Prev

of

Next

To assess the company's liquidity and asset management, compute the following for this year and last year:

a Working capital.

b The current ratio.

Note: Round your final answers to decimal places.

c The acidtest ratio.

Note: Round your final answers to decimal places.

d The average collection period. The accounts receivable at the beginning of last year totaled $

Note: Use days in a year. Round your intermediate calculations and final answers to mathbf decimal place.

e The average sale period. The inventory at the beginning of last year totaled $

Note: Use days in a year. Round your intermediate calculations and final answers to mathbf decimal place.

f The operating cycle.

Note: Round your intermediate calculations and final answers to decimal place.

g The total asset turnover. The total assets at the beginning of last year totaled $

Note: Round your final answers to mathbf decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock