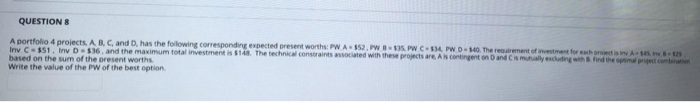

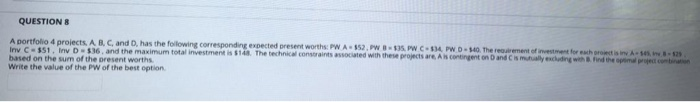

Question: I hope this one is clear!!! A portfolio 4 projects A ,B ,C ,D has the following corresponding expected present worth Pw A=52$, Pw B=35$.

QUESTIONS 20 PW D340. The recurement of investment for the rest is in contingent on and is mutually excluding the pomalo A portfolio 4 projects, A C , and has the following corresponding vected present worth PWA.352.PW P W C 4 Iny C-551, Inv D-$16, and the maximum total investment is $14. The technical constraints associated with these projects are a based on the sum of the present worth Write the value of the PW of the best option QUESTIONS 20 PW D340. The recurement of investment for the rest is in contingent on and is mutually excluding the pomalo A portfolio 4 projects, A C , and has the following corresponding vected present worth PWA.352.PW P W C 4 Iny C-551, Inv D-$16, and the maximum total investment is $14. The technical constraints associated with these projects are a based on the sum of the present worth Write the value of the PW of the best option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts