Question: I. How much should be reported as Trading Securities as of December 31, 2019? II. How much unrealized gain or loss to be reported in

I. How much should be reported as Trading Securities as of December 31, 2019?

II. How much unrealized gain or loss to be reported in the income statement for 2019?

III. How much gain or loss should be recognized in relation to the sale of B ordinary shares?

IV. How much unrealized gain or loss to be reported in the income statement for 2020?

V. How much should be reported as Trading Securities as of December 31, 2020?

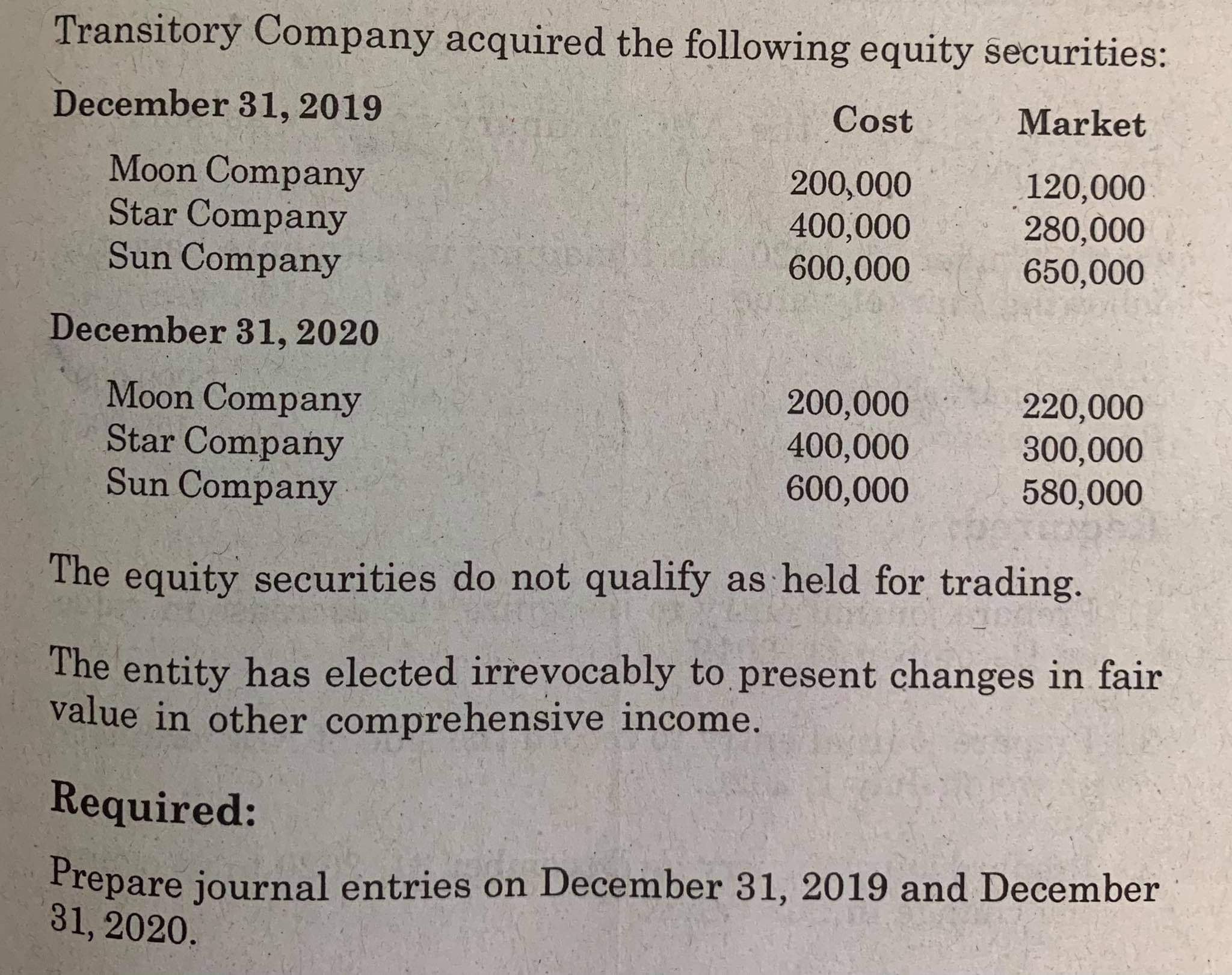

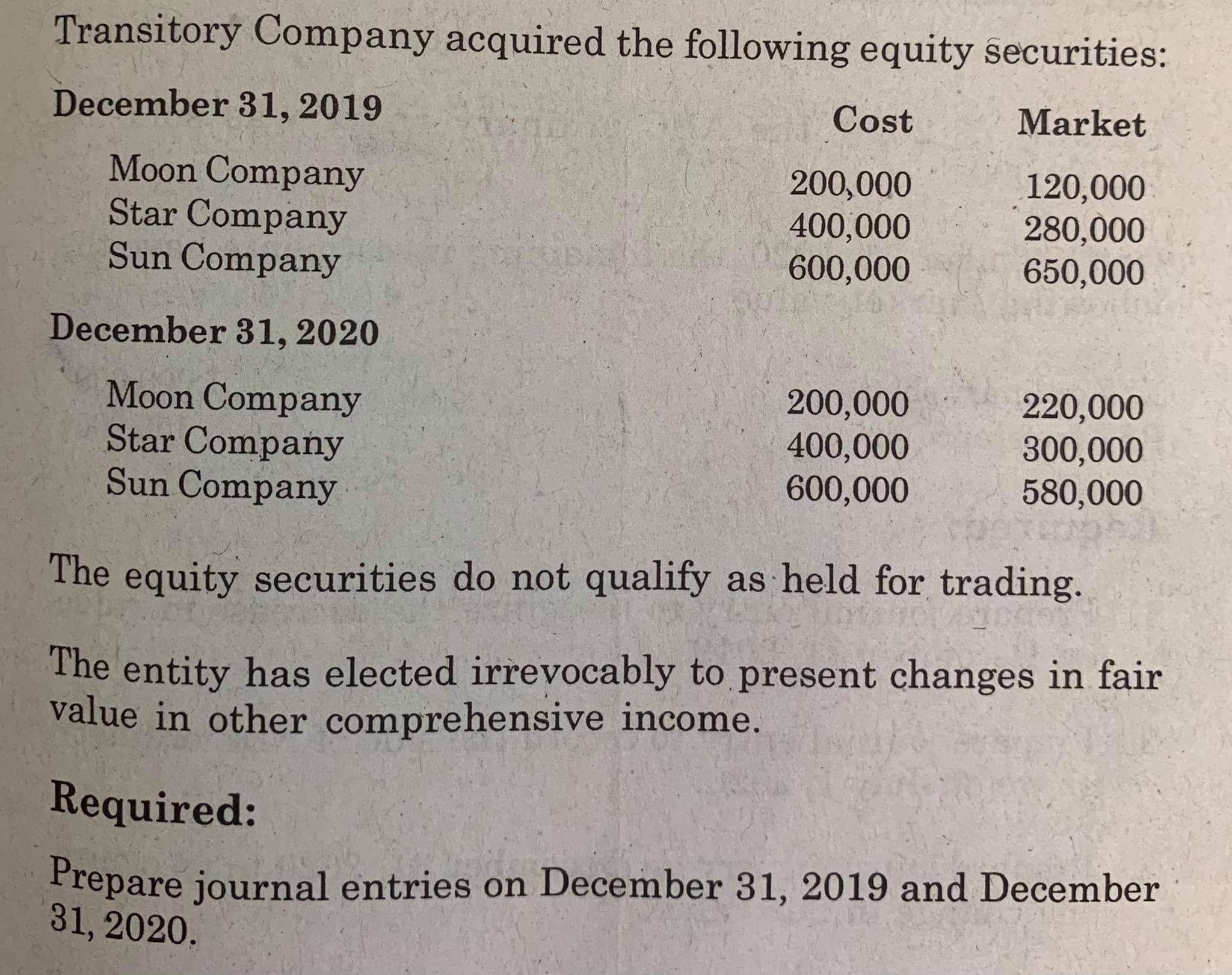

Transitory Company acquired the following equity securities: December 31, 2019 Cost Market Moon Company 200,000 120,000 Star Company 400, 000 280,000 Sun Company 600,000 650,000 December 31, 2020 Moon Company 200,000 220,000 Star Company 400,000 300,000 Sun Company 600,000 580,000 The equity securities do not qualify as held for trading. The entity has elected irrevocably to present changes in fair value in other comprehensive income. Required: Prepare journal entries on December 31, 2019 and December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts