Question: i hust need help with this problem, i can't remember how to do it and its due soon!!! Instructions The following items were selected from

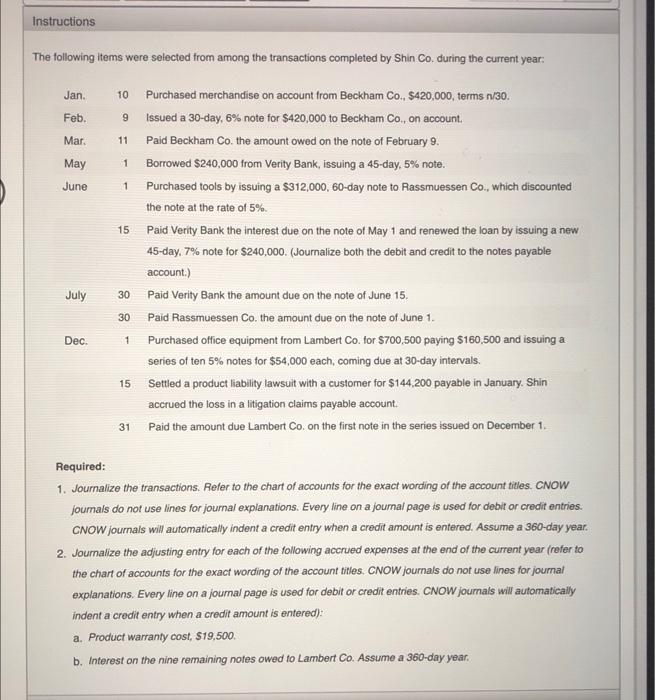

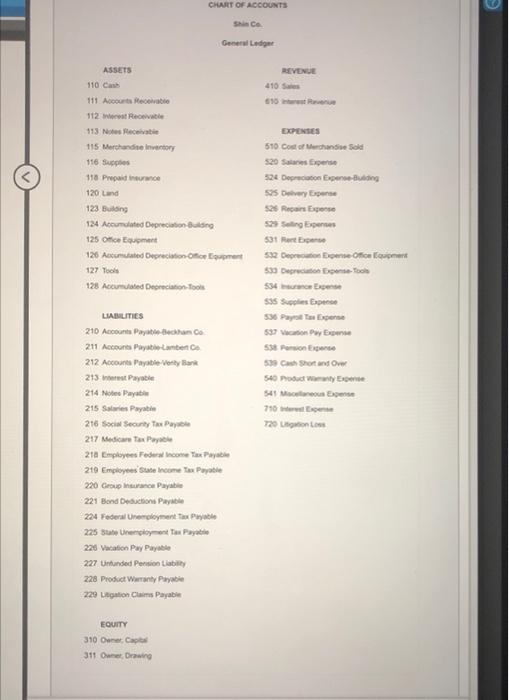

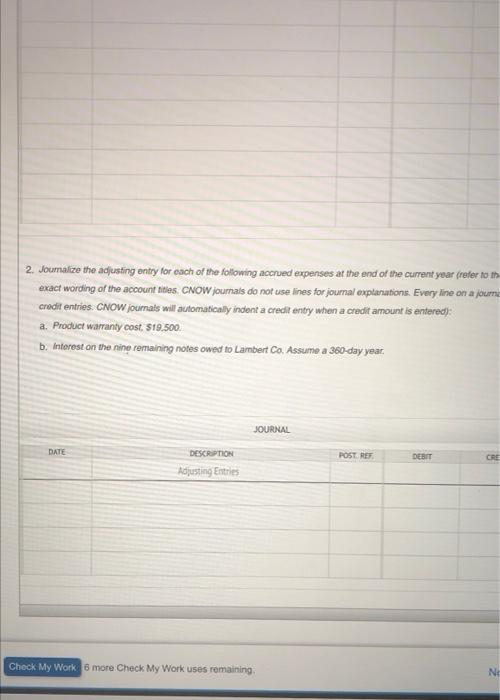

Instructions The following items were selected from among the transactions completed by Shin Co. during the current year: Jan. Feb. Mar. 11 May 1 June 1 15 10 Purchased merchandise on account from Beckham Co., $420,000, terms 1/30. 9 Issued a 30-day, 6% note for $420,000 to Beckham Co., on account. Paid Beckham Co the amount owed on the note of February 9. Borrowed $240,000 from Verity Bank, issuing a 45-day, 5% note. Purchased tools by issuing a $312,000, 60-day note to Rassmuessen Co., which discounted the note at the rate of 5% Paid Verity Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $240,000. (Journalize both the debit and credit to the notes payable account.) Paid Verity Bank the amount due on the note of June 15. Paid Rassmuessen Co the amount due on the note of June 1. Purchased office equipment from Lambert Co. for $700,500 paying $160,500 and issuing a series of ten 5% notes for $54,000 each, coming due at 30-day intervals. 15 Settled a product liability lawsuit with a customer for $144,200 payable in January. Shin accrued the loss in a litigation claims payable account. 31 Paid the amount due Lambert Co. on the first note in the series issued on December 1. July 30 30 Dec 1 Required: 1. Joumalize the transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW Journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Assume a 360-day year. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the chart of accounts for the exact wording of the account titles. CNOW Journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. Product warranty cost, $19,500 b. Interest on the nine remaining notes owed to Lambert Co. Assume a 360-day year. CHART OF ACCOUNTS SC General Ledger ASSETS 110 C 111 Account Recova 112 Revel REVENUE 410 S 610 115 Merchandiseinator 116 Supplies 118 Prepaid 120 Land 123 Bulong 124 Accurated Depreciation ng 125 Otice gument 126 Accurated Depreciation form 127 Tools 128 Accurated Depreciation Tools EXPENSES 510 Cost of Merchandise 520 Sales Expense 524 Den Eng 535 vypse 526 Roar Esponse 52 Sing Expo 531 Robe 592 Deprecated Dome Office in 530 Dec Tools 534 S35 Solis 536 Payone 597 Vacation Pay Ban 538 PoE 53 Short and Over 540 Pou mwen 541 cu pense 710 T20 L LIABILITIES 210 Accounts Payabianco 211 Accounts Payable Lambert 212 Accounts Payable Very Blank 213 Payable 214 Nee Paythe 215 Sales Payable 216 Social Security To 217 Medicare Pay 210 Employees Federat Income Tax 219 Employees State income Tax Payable 220 Group Insurance Payable 221 Bond Deductions Payable 224 Federal Unerloyment Tax Pwyle 225 Union Pay 226 Vacation Pay Payable 227 Untunded Pension by 228 Product Warranty Payabie 229 Litigation Claims Payable EQUITY 310 Omar, Capital 311 Owner Drawing BOOK Show Me How contato com ONOW med for ONOWO tywod JOURNAL POSTE 11 ST 16 It TE It 20 HOW ME HOW or the exact warning of the account the CNCW jumals do not new for our platos Erwyn a w automatically indent a creditentry when a credit amount is entened. Assume a 360-day your foot INGE 1 JOURNAL ACCOUNTING EQUATION POSTE DOT CREDIT ANTI BUT tout 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to th exact wording of the account hitles. CNOW joumats do not use lines for journal explanations. Every line on a journe credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. Product warranty cost. $19.500 b. Interest on the nine romaining notes owed to Lambert Co. Assume a 360-day year, JOURNAL DATE POST REF DEBIT CRE DESCRIPTION Adjusting Entries Check My Work 6 more Check My Work uses remaining, NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts