Question: I I need help with the red boxes (incorrect answers only) please! Exercise 11-11 (Part Level Submission) Ramirez Company has the following data for the

I

I

I need help with the red boxes (incorrect answers only) please!

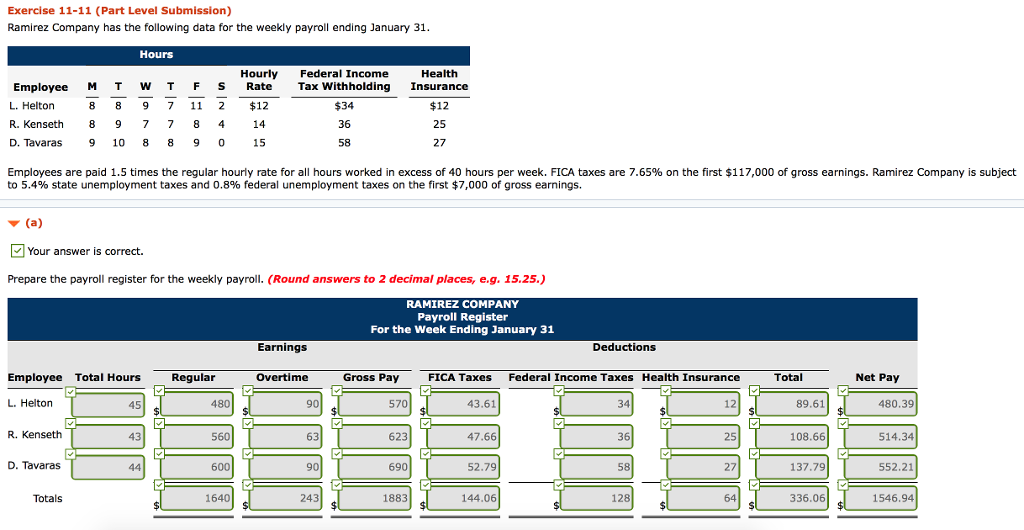

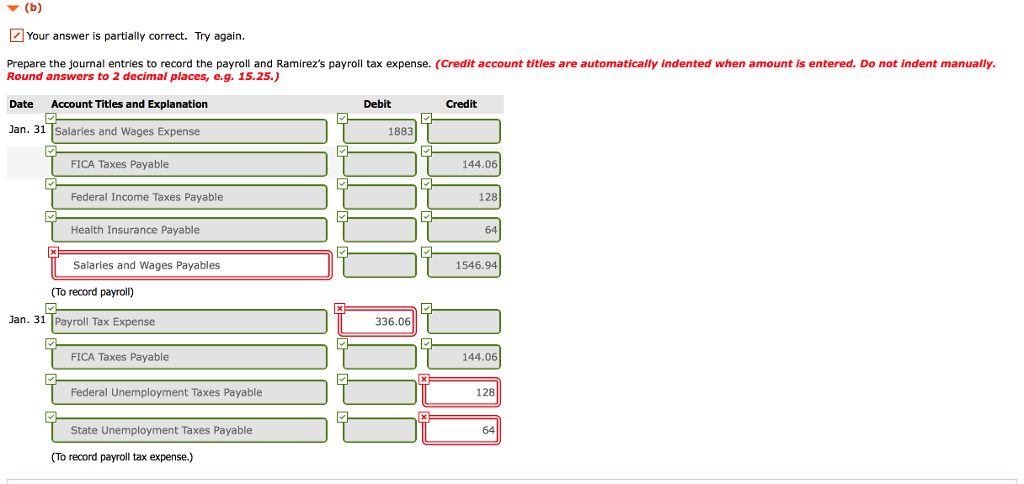

Exercise 11-11 (Part Level Submission) Ramirez Company has the following data for the weekly payroll ending January 31 Hours Hourly Federal Income Health Employee M T WTF L. Helton R. Kenseth 8 9 77 8 4 14 D. Tavaras 9 10 8 8 9 0 S Rate Tax Withholding Insurance $34 36 58 $12 25 27 8 8 9 7 11 2 12 15 Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $117,000 of gross earnings. Ramirez Company is subje to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings. Your answer is correct. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) RAMIREZ COMPANY Payroll Register For the Week Ending January 31 Earnings Deductions Employee Total Hours Regular Overtime Gross Pay FICA Taxes Federal Income Taxes Health Insurance Total Net Pay L. Helton 45 480 90 570 43.61 34 89.61 480.39 R. Kenseth 43 560 63 623 47.66 36 25 108.66 514.34 D. Tavaras 600 90 690 52.79 58 27 137.79 552.21 Totals 1640 243 1883 144.06 128 64 336.06 1546.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts