Question: I I need p2 q3 Problem 2 (27 points) Suppose you hold a 6.80 percent coupon bond with a par value of $1,000, that matures

I

I need p2 q3

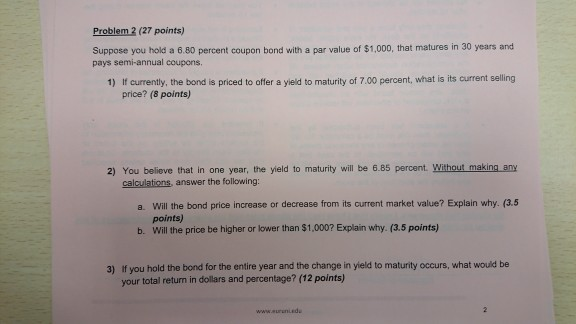

Problem 2 (27 points) Suppose you hold a 6.80 percent coupon bond with a par value of $1,000, that matures in 30 years and pays semi-annual coupons. 1) If currently, the bond is priced to offer a yield to maturity of 7.00 percent, what is its current selling price? (8 points) 2) You believe that in one year, the yield to maturity will be 6.85 percent. Without making any calculations, answer the following: a. Will the bond price increase or decrease from its current market value? Explain why. (3.5 points) b. Will the price be higher or lower than $1,000? Explain why. (3.5 points) 3) if you hold the bond for the entire year and the change in yield to maturity occurs, what would be your total return in dollars and percentage? (12 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts