Question: I. Journalizing Transactions. a) June 1 - Signed a $15,000, 12 month note at First Bank, 8.25% APR. b) June 1 - Received $25,000 from

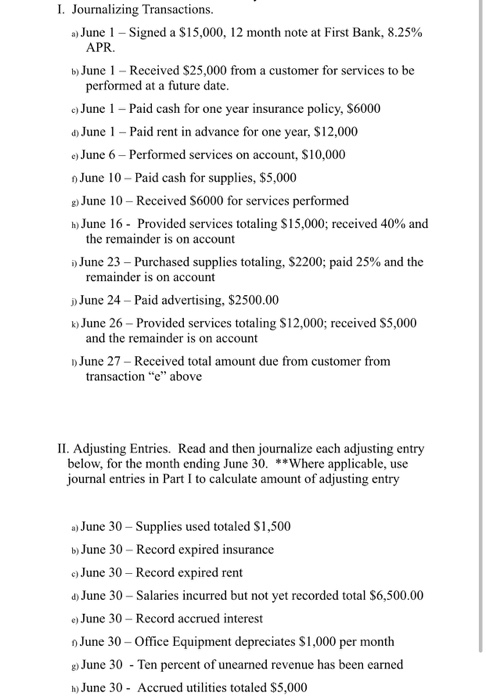

I. Journalizing Transactions. a) June 1 - Signed a $15,000, 12 month note at First Bank, 8.25% APR. b) June 1 - Received $25,000 from a customer for services to be performed at a future date. c) June 1 - Paid cash for one year insurance policy, $6000 d) June 1 - Paid rent in advance for one year, $12,000 c) June 6 - Performed services on account, $10,000 ) June 10 - Paid cash for supplies, $5,000 g) June 10 - Received 56000 for services performed h) June 16 - Provided services totaling $15,000; received 40% and the remainder is on account June 23 - Purchased supplies totaling, $2200; paid 25% and the remainder is on account June 24 - Paid advertising, $2500.00 k) June 26 - Provided services totaling $12,000; received $5,000 and the remainder is on account June 27 - Received total amount due from customer from transaction "e" above II. Adjusting Entries. Read and then journalize cach adjusting entry below, for the month ending June 30. **Where applicable, use journal entries in Part I to calculate amount of adjusting entry a) June 30 - Supplies used totaled S1,500 b) June 30 - Record expired insurance c) June 30 - Record expired rent d) June 30 - Salaries incurred but not yet recorded total $6,500.00 c) June 30 - Record accrued interest 1) June 30 - Office Equipment depreciates $1,000 per month 8) June 30 - Ten percent of unearned revenue has been earned h) June 30 - Accrued utilities totaled $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts