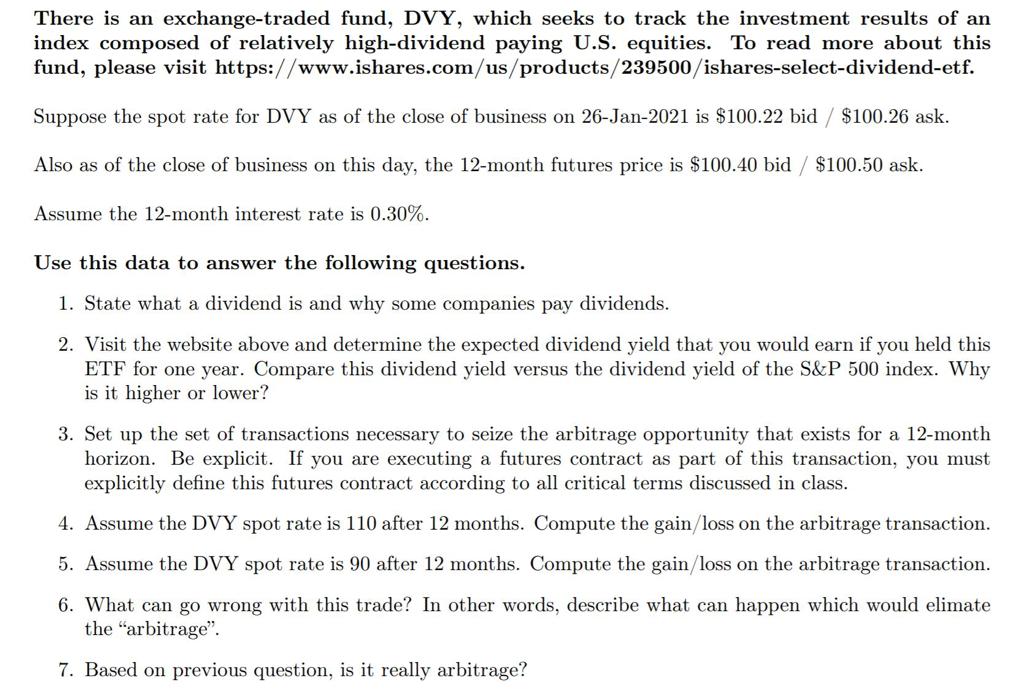

Question: I just help with question 3 Link: https://www.ishares.com/us/products/239500/ishares-select-dividend-etf There is an exchangetraded fund, DVY, which seeks to track the investment results of an index composed

I just help with question 3

Link: https://www.ishares.com/us/products/239500/ishares-select-dividend-etf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts