Question: I just need #2 Ch 7 homework assignment (See powerpoints 2527 for formula and example problem calculating WACC and set up a similar chart.) 11.

I just need #2

I just need #2

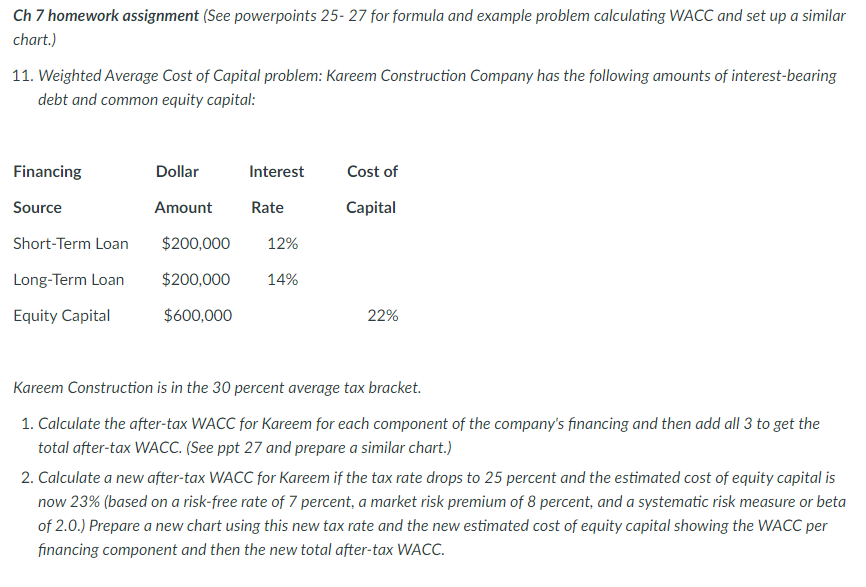

Ch 7 homework assignment (See powerpoints 2527 for formula and example problem calculating WACC and set up a similar chart.) 11. Weighted Average Cost of Capital problem: Kareem Construction Company has the following amounts of interest-bearing debt and common equity capital: Kareem Construction is in the 30 percent average tax bracket. 1. Calculate the after-tax WACC for Kareem for each component of the company's financing and then add all 3 to get the total after-tax WACC. (See ppt 27 and prepare a similar chart.) 2. Calculate a new after-tax WACC for Kareem if the tax rate drops to 25 percent and the estimated cost of equity capital is now 23% (based on a risk-free rate of 7 percent, a market risk premium of 8 percent, and a systematic risk measure or beta of 2.0.) Prepare a new chart using this new tax rate and the new estimated cost of equity capital showing the WACC per financing component and then the new total after-tax WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts