Question: I just need assistance with question 8 & 9 face a 35% tax rate. Zona estimates the risk-free rate to be 7.2% and the market

I just need assistance with question 8 & 9

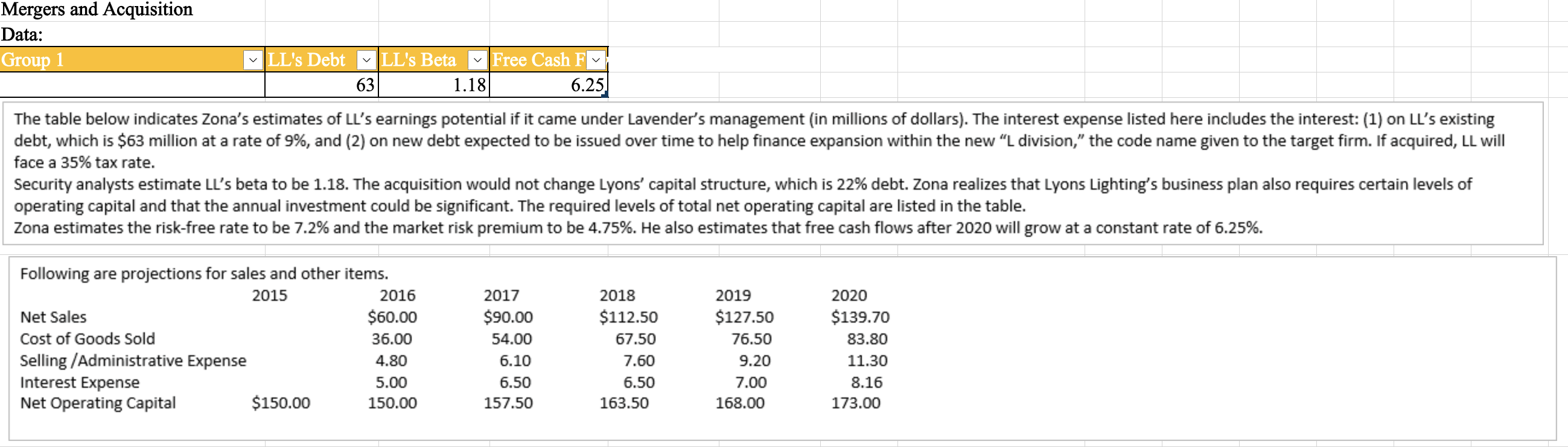

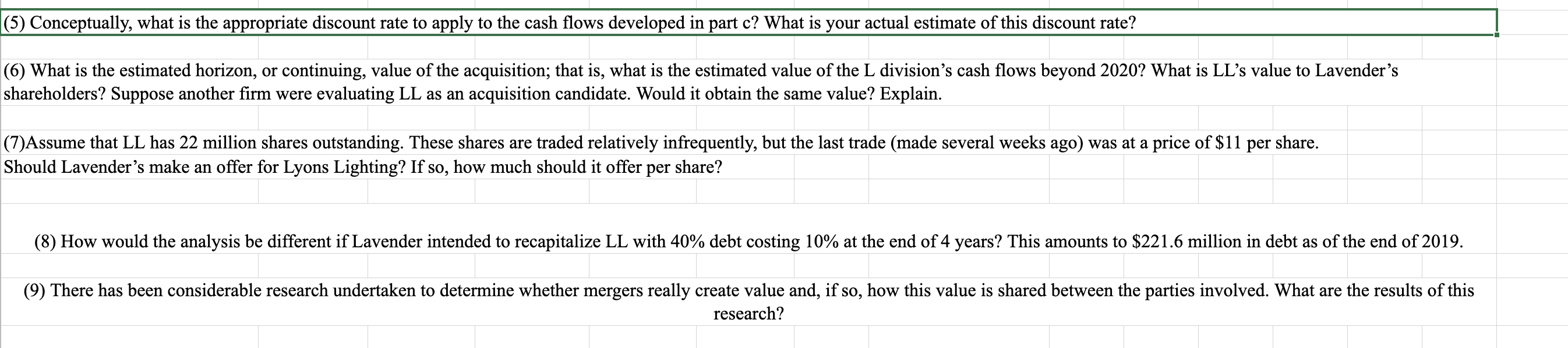

face a 35% tax rate. Zona estimates the risk-free rate to be 7.2% and the market risk premium to be 4.75%. He also estimates that free cash flows after 2020 will grow at a constant rate 6.25%. (5) Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part c? What is your actual estimate of this discount rate? shareholders? Suppose another firm were evaluating LL as an acquisition candidate. Would it obtain the same value? Explain. (7)Assume that LL has 22 million shares outstanding. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of $11 per share. Should Lavender's make an offer for Lyons Lighting? If so, how much should it offer per share? (8) How would the analysis be different if Lavender intended to recapitalize LL with 40% debt costing 10% at the end of 4 years? This amounts to $221.6 million in debt as of the end of 2019 . (9) There has been considerable research undertaken to determine whether mergers really create value and, if so, how this value is shared between the parties involved. What are the results of this research? face a 35% tax rate. Zona estimates the risk-free rate to be 7.2% and the market risk premium to be 4.75%. He also estimates that free cash flows after 2020 will grow at a constant rate 6.25%. (5) Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part c? What is your actual estimate of this discount rate? shareholders? Suppose another firm were evaluating LL as an acquisition candidate. Would it obtain the same value? Explain. (7)Assume that LL has 22 million shares outstanding. These shares are traded relatively infrequently, but the last trade (made several weeks ago) was at a price of $11 per share. Should Lavender's make an offer for Lyons Lighting? If so, how much should it offer per share? (8) How would the analysis be different if Lavender intended to recapitalize LL with 40% debt costing 10% at the end of 4 years? This amounts to $221.6 million in debt as of the end of 2019 . (9) There has been considerable research undertaken to determine whether mergers really create value and, if so, how this value is shared between the parties involved. What are the results of this research

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts