Question: I just need C Problem You will analyze four projects that your company wants to invest in. You are going to use two different methods

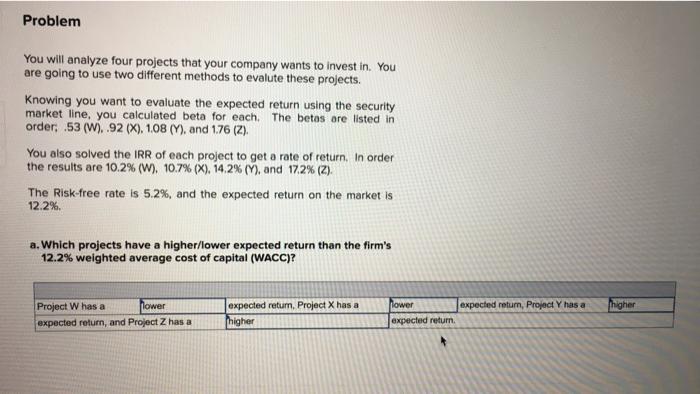

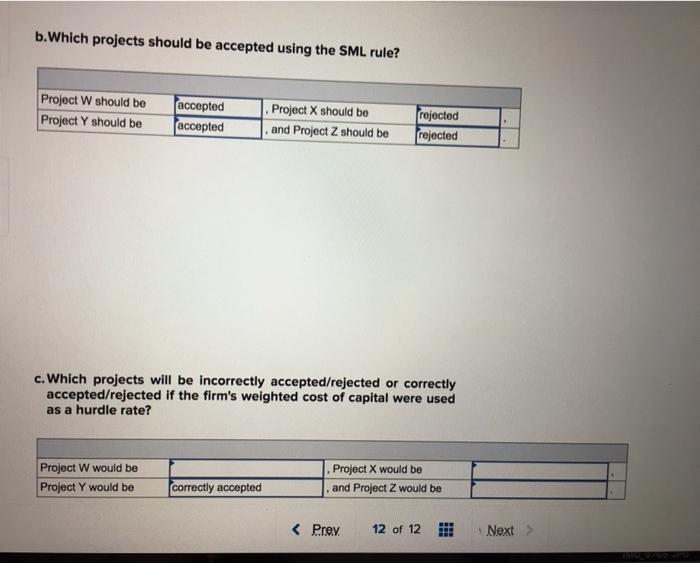

Problem You will analyze four projects that your company wants to invest in. You are going to use two different methods to evalute these projects. Knowing you want to evaluate the expected return using the security market line, you calculated beta for each. The betos are listed in order, .53 (W) 92 (X). 1.08 (Y)and 1.76 (Z). You also solved the IRR of each project to get a rate of return. In order the results are 10.2% (W), 10.7% (X). 14.2% (), and 172% (Z). The Risk-free rate is 5.2%, and the expected return on the market is 12.2%. a. Which projects have a higher/lower expected return than the firm's 12.2% weighted average cost of capital (WACC)? expected return, Project Y has a Thigher Project W has a flower expected return, and Project Z has a expected return. Project X has a higher lower expected return b.Which projects should be accepted using the SML rule? Project W should be Project Y should be accepted accepted Project X should be and Project Z should be rejected rejected c. Which projects will be incorrectly accepted/rejected or correctly accepted/rejected if the firm's weighted cost of capital were used as a hurdle rate? Project W would be Project Y would be Project X would be and Project Z would be correctly accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts