Question: i just need #D Netpresent value method -annulty Jones Excavation Company is planning an investment of $81,960 for a bulldozer. The bulldozer is expected to

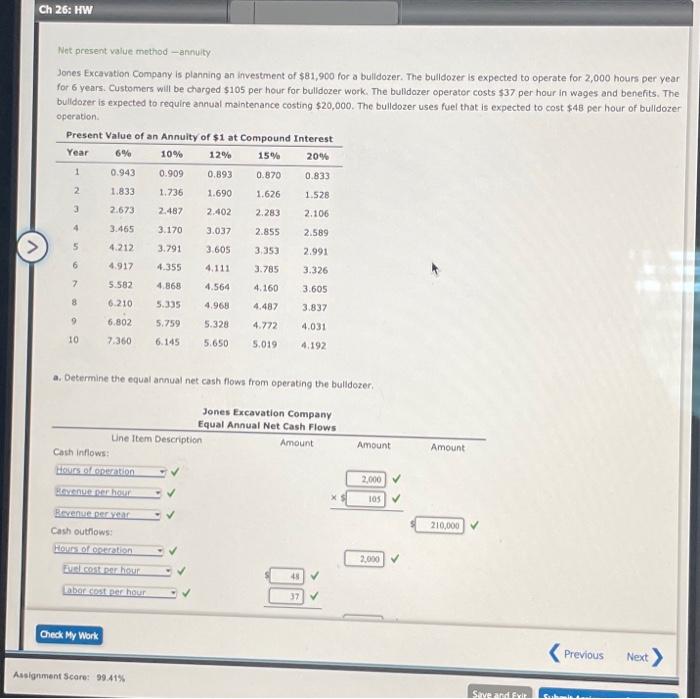

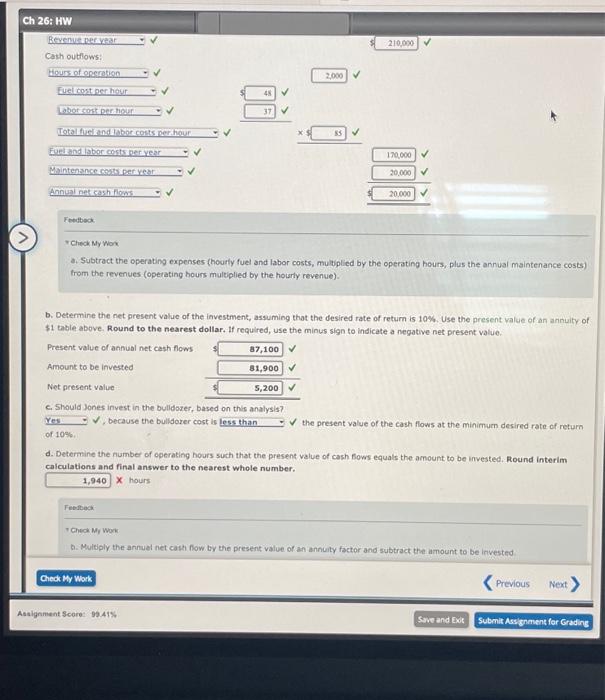

Netpresent value method -annulty Jones Excavation Company is planning an investment of $81,960 for a bulldozer. The bulldozer is expected to operate for 2,000 hours per year for 6 years. Customers will be charged $105 per hour for bulldozer work. The bulldozer operator costs $37 per hour in wages and benefits. The bulidozer is expected to require annual maintenance costing $20,000. The bulldozer uses fuel that is expected to cost $48 per hour of bulldozer operation. a. Determine the equal annual net cash flows from operating the bulldozer, v Ched My Wox a. Subtract the operating expenses theurly fuel and labor costs, muliplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). b. Determine the net present value of the investmenk, assuming that the desired rate of return is 10%. Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. C. Shauld Jones inyest in the bulldover, based on this analysis? V. because the bulldozer cost is of 10si; the present value of the cash flows at the minimum desired rate of return d. Determine the number of operating hours such that the present value of cash fows equals the amount to be invested. Round interim calculations and final answer to the nearest whole number. x hours * Cheak Mr Work b. Multiply the annuel net casti fow by the present value of an annuity factor and subtract the amount to be invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts