Question: I just need from g-k, I have done everything else. Thank you Question 1 Using T-accounts, please record the following transactions. a) M&B Bank PLC

I just need from g-k, I have done everything else. Thank you

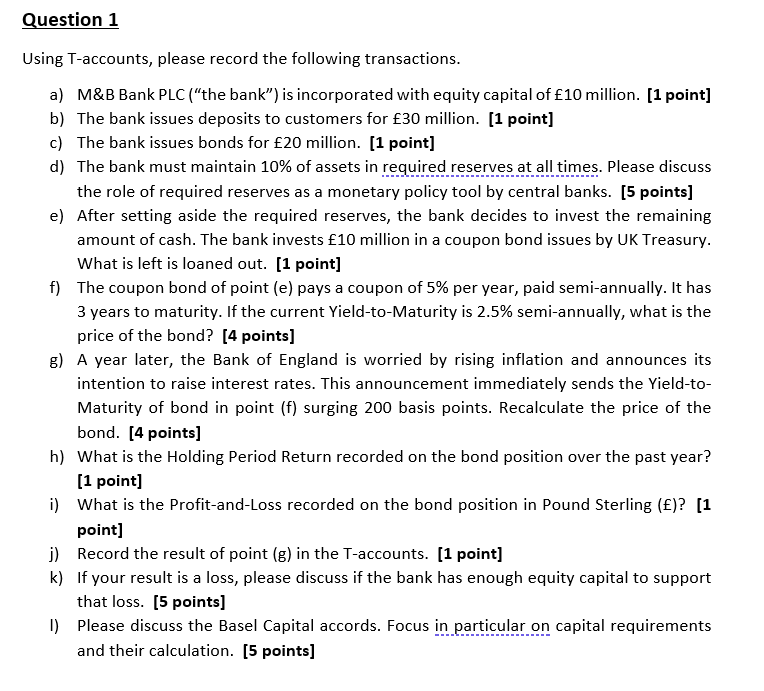

Question 1 Using T-accounts, please record the following transactions. a) M&B Bank PLC (the bank) is incorporated with equity capital of 10 million. [1 point] b) The bank issues deposits to customers for 30 million. [1 point] c) The bank issues bonds for 20 million. (1 point] d) The bank must maintain 10% of assets in required reserves at all times. Please discuss the role of required reserves as a monetary policy tool by central banks. [5 points] e) After setting aside the required reserves, the bank decides to invest the remaining amount of cash. The bank invests 10 million in a coupon bond issues by UK Treasury. What is left is loaned out. (1 point] f) The coupon bond of point (e) pays a coupon of 5% per year, paid semi-annually. It has 3 years to maturity. If the current Yield-to-Maturity is 2.5% semi-annually, what is the price of the bond? [4 points] g) A year later, the Bank of England is worried by rising inflation and announces its intention to raise interest rates. This announcement immediately sends the Yield-to- Maturity of bond in point (f) surging 200 basis points. Recalculate the price of the bond. [4 points] h) What is the Holding Period Return recorded on the bond position over the past year? [1 point] i) What is the Profit-and-Loss recorded on the bond position in Pound Sterling ()? [1 point] j) Record the result of point (g) in the T-accounts. [1 point] k) If your result is a loss, please discuss if the bank has enough equity capital to support that loss. [5 points) 1) Please discuss the Basel Capital accords. Focus in particular on capital requirements and their calculation. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts