Question: I just need guidance on which entry is overstated or understated. a. is Insurance Expense b. is Sales Revenue c. is Supplies Expense d. is

I just need guidance on which entry is overstated or understated.

I just need guidance on which entry is overstated or understated.

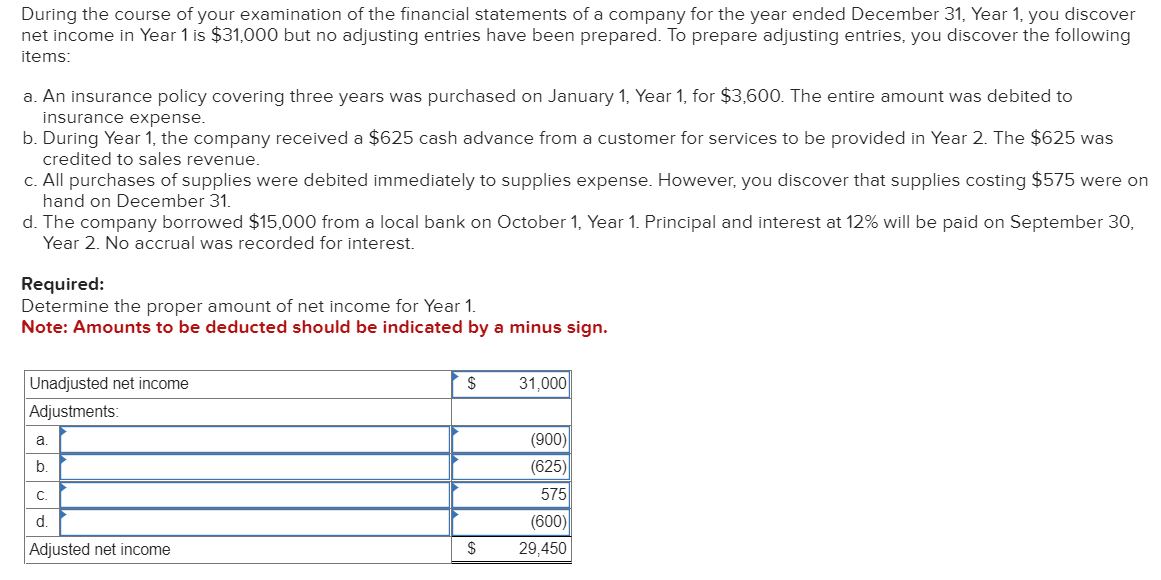

a. is Insurance Expense

b. is Sales Revenue

c. is Supplies Expense

d. is Interest Expense

During the course of your examination of the financial statements of a company for the year ended December 31 , Year 1 , you discover net income in Year 1 is $31,000 but no adjusting entries have been prepared. To prepare adjusting entries, you discover the following items: a. An insurance policy covering three years was purchased on January 1 , Year 1 , for $3,600. The entire amount was debited to insurance expense. b. During Year 1 , the company received a $625 cash advance from a customer for services to be provided in Year 2 . The $625 was credited to sales revenue. c. All purchases of supplies were debited immediately to supplies expense. However, you discover that supplies costing $575 were on hand on December 31. d. The company borrowed $15,000 from a local bank on October 1 , Year 1 . Principal and interest at 12% will be paid on September 30 , Year 2. No accrual was recorded for interest. Required: Determine the proper amount of net income for Year 1. Note: Amounts to be deducted should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts