Question: I just need help calculating goodwill Purchase price Bookvalue: Common Stock Retained Earnings APIC FMV > Inventory Land Building and Equipment Covenent-not-to-complete Bonds Payable Total

I just need help calculating goodwill

| Purchase price | ||

| Bookvalue: | ||

| Common Stock | ||

| Retained Earnings | ||

| APIC | ||

| FMV > | ||

| Inventory | ||

| Land | ||

| Building and Equipment | ||

| Covenent-not-to-complete | ||

| Bonds Payable | ||

| Total FMV of Net Assets of Salt | ||

| Goodwill | ||

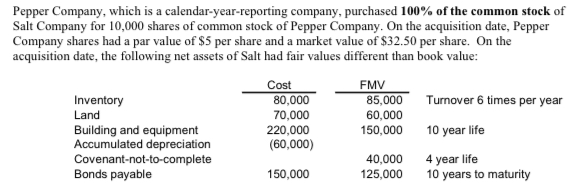

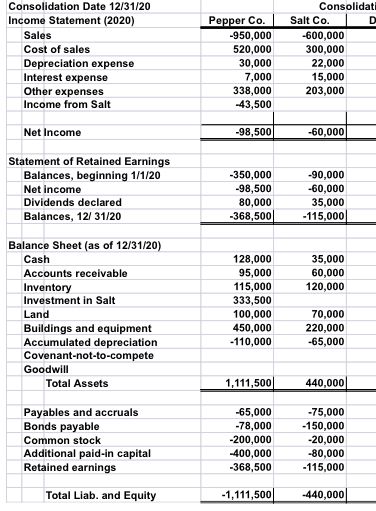

Pepper Company, which is a calendar-year-reporting company, purchased 100% of the common stock of Salt Company for 10,000 shares of common stock of Pepper Company. On the acquisition date, Pepper Company shares had a par value of $5 per share and a market value of $32.50 per share. On the acquisition date, the following net assets of Salt had fair values different than book value: Cost FMV Inventory 80,000 85,000 Turnover 6 times per year Land 70,000 60,000 Building and equipment 220,000 150,000 10 year life Accumulated depreciation (60,000) Covenant-not-to-complete 40,000 4 year life Bonds payable 150,000 125,000 10 years to maturity Consolidation Date 12/31/20 Income Statement (2020) Sales Cost of sales Depreciation expense Interest expense Other expenses Income from Salt Pepper Co. -950,000 520,000 30,000 7,000 338,000 -43,500 Consolidat Salt Co. D -600,000 300,000 22,000 15,000 203,000 Net Income -98,500 -60,000 Statement of Retained Earnings Balances, beginning 1/1/20 Net income Dividends declared Balances, 12/31/20 -350,000 -98,500 80,000 -368,500 -90,000 -60,000 35,000 - 115,000 35,000 60,000 120,000 Balance Sheet (as of 12/31/20) Cash Accounts receivable Inventory Investment in Salt Land Buildings and equipment Accumulated depreciation Covenant-not-to-compete Goodwill Total Assets 128,000 95,000 115,000 333,500 100,000 450,000 -110,000 70,000 220,000 -65,000 1,111,500 440,000 Payables and accruals Bonds payable Common stock Additional paid-in capital Retained earnings -65,000 -78,000 -200,000 -400,000 -368,500 -75,000 -150,000 -20,000 -80,000 -115,000 Total Liab, and Equity -1,111,500 -440,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts