Question: i just need help foguring out part b. i got 15,400, but that isnt right. Effect of doubtful accounts on net income During its first

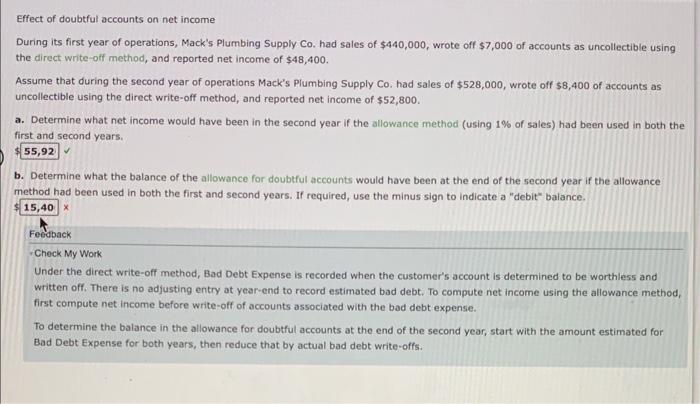

Effect of doubtful accounts on net income During its first year of operations, Mack's Plumbing Supply Co. had sales of $440,000, wrote off $7,000 of accounts as uncollectible using the direct write-off method, and reported net income of $48,400. Assume that during the second year of operations Mack's Plumbing Supply Co. had sales of $528,000, wrote off $8,400 of accounts as uncollectible using the direct write-off method, and reported net income of $52,800. a. Determine what net income would have been in the second year if the allowance method (using 1% of sales) had been used in both the first and second years. b. Determine what the balance of the allowance for doubtful accounts would have been at the end of the second year if the allowance method had been used in both the first and second years. If required, use the minus sign to indicate a "debit" balance. Feedback Check My Work Under the direct write-off method, Bad Debt Expense is recorded when the customer's account is determined to be worthless and written off. There is no adjusting entry at year-end to record estimated bad debt. To compute net income using the allowance method, first compute net income before write-off of accounts associated with the bad debt expense. To determine the balance in the allowance for doubtful accounts at the end of the second year, start with the amount estimated for Bad Debt Expense for both years, then reduce that by actual bad debt write-offs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts