Question: I Just need help with #26 & #27 please? McGonigal's Meats, Inc. currently pays no dividends. The firm plans to begin paying dividends in 3

I Just need help with #26 & #27 please?

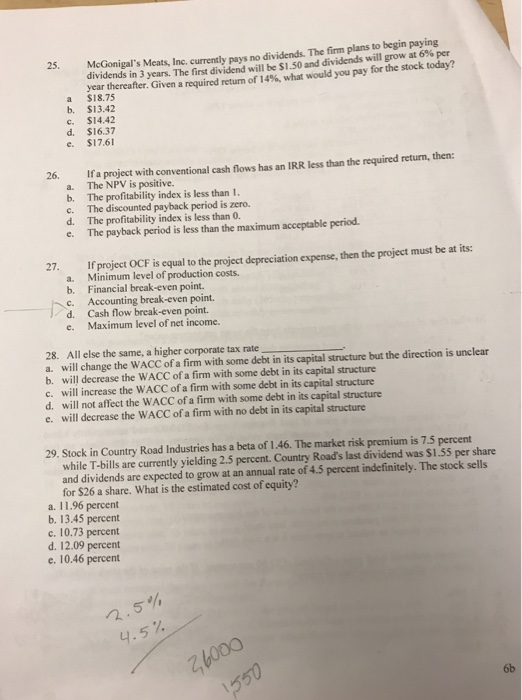

I Just need help with #26 & #27 please? McGonigal's Meats, Inc. currently pays no dividends. The firm plans to begin paying dividends in 3 years. The first dividend will be $1.50 and dividends will grow at 6% per year thereafter. Given a required return of 14%, what would you pay for the stock today? a. $18.75 b. $13.42 c. $14.42 d. $16.37 e. $17.61 If a project with conventional cash flows has an IRR less than the required return, then: a. The NPV is positive. b. The profitability index is less than 1. c. The discounted payback period is zero. d. The profitability index is less than 0. e. The payback period is less than the maximum acceptable period. If project OCF is equal to the project depreciation expense, then the project must be at its: a. Minimum level of production costs. b. Financial break-even point. c. Accounting break-even point. d. Cash flow break-even point. e. Maximum level of net income. All else the same, a higher corporate tax rate _____. a. will change the WACC of a firm with some debt in its capital structure but the direction is unclear b. will decrease the WACC of a firm with some debt in its capital structure c. will increase the WACC of a firm with some debt in its capital structure d. will not affect the WACC of a firm with some debt in its capital structure e. will decrease the WACC of a firm with no debt in its capital structure Stock in Country Road Industries has a beta of 1.46. The market risk premium is 7.5 percent while T-bills are currently yielding 2.5 percent. Country Road's last dividend was $1.55 per share and dividends are expected to grow at an annual rate of 4.5 percent indefinitely. The stock sells for $26 a share. What is the estimated cost of equity? a. 11.96 percent b. 13.45 percent c. 10.73 percent d. 12.09 percent e. 10.46 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts