Question: i just need help with 6,7, and 8, please. 6. A farmer takes a short position in 2 corn futures contracts with a maturity in

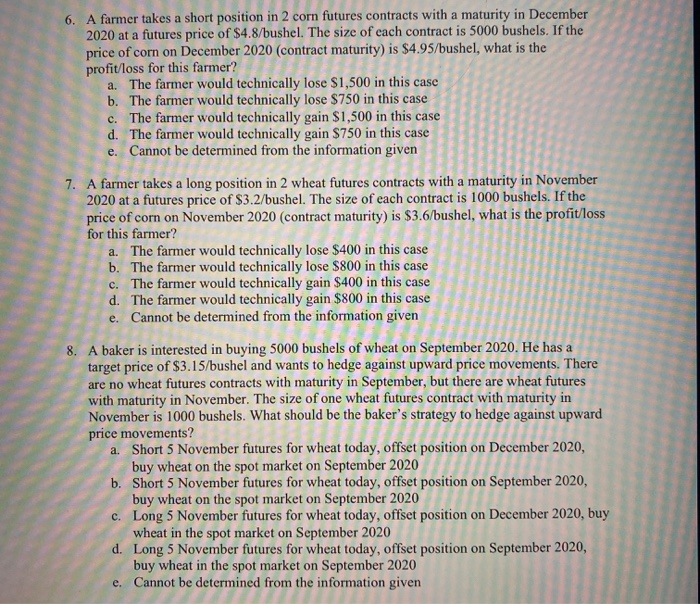

6. A farmer takes a short position in 2 corn futures contracts with a maturity in December 2020 at a futures price of $4.8/bushel. The size of each contract is 5000 bushels. If the price of corn on December 2020 (contract maturity) is $4.9S/bushel, what is the profit/loss for this farmer? a. The farmer would technically lose $1,500 in this case b. The farmer would technically lose $750 in this case c. The farmer would technically gain $1,500 in this case d. The farmer would technically gain $750 in this case e. Cannot be determined from the information given 7. A farmer takes a long position in 2 wheat futures contracts with a maturity in November 2020 at a futures price of $3.2/bushel. The size of each contract is 1000 bushels. If the price of corn on November 2020 (contract maturity) is $3.6/bushel, what is the profit/loss for this farmer? a. The farmer would technically lose $400 in this case b. The farmer would technically lose $800 in this case c. The farmer would technically gain $400 in this case d. The farmer would technically gain $800 in this case e. Cannot be determined from the information given 8. A baker is interested in buying 5000 bushels of wheat on September 2020. He has target price of $3.15/bushel and wants to hedge against upward price movements. There are no wheat futures contracts with maturity in September, but there are wheat futures with maturity in November. The size of one wheat futures contract with maturity in November is 1000 bushels. What should be the baker's strategy to hedge against upward price movements? a. Short 5 November futures for wheat today, offset position on December 2020, buy wheat on the spot market on September 2020 b. Short 5 November futures for wheat today, offset position on September 2020, buy wheat on the spot market on September 2020 c. Long 5 November futures for wheat today, offset position on December 2020, buy wheat in the spot market on September 2020 d. Long 5 November futures for wheat today, offset position on September 2020, buy wheat in the spot market on September 2020 e. Cannot be determined from the information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts