Question: I just need help with a reply back to this. please and thank you! 8-5 Stock A has an expected return of 7%, a standard

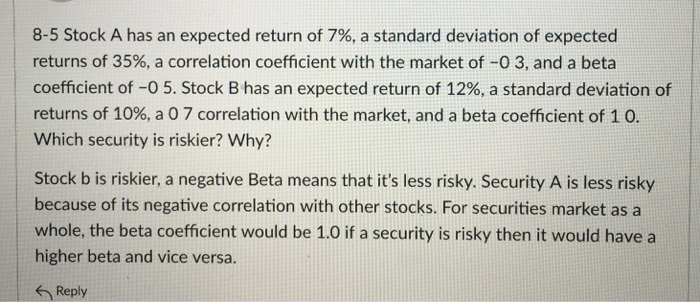

8-5 Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, a correlation coefficient with the market of-O 3, and a beta coefficient of-0 5. Stock B has an expected return of 12%, a standard deviation of returns of 10%, a 0 7 correlation with the market, and a beta coefficient of 1 0. Which security is riskier? Why? Stock b is riskier, a negative Beta means that it's less risky. Security A is less risky because of its negative correlation with other stocks. For securities market as a whole, the beta coefficient would be 1.0 if a security is risky then it would have a higher beta and vice versa | Reply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts