Question: I just need help with a reply to this post. thank you so much. Question 8-6: A stock had a 12% return last year, a

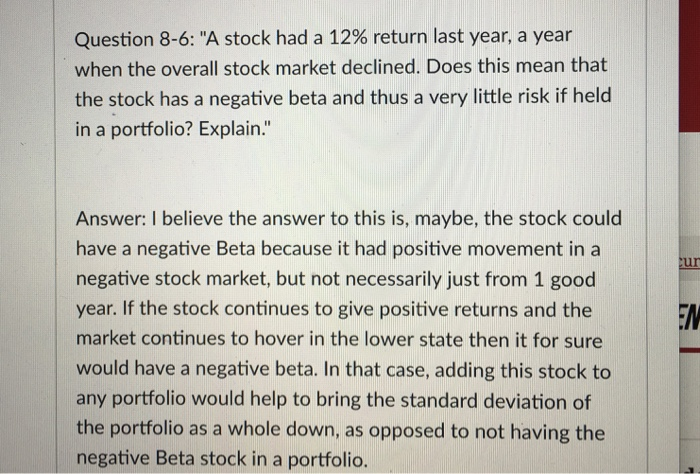

Question 8-6: "A stock had a 12% return last year, a year when the overall stock market declined. Does this mean that the stock has a negative beta and thus a very little risk if held in a portfolio? Explain." Answer: I believe the answer to this is, maybe, the stock could have a negative Beta because it had positive movement in a negative stock market, but not necessarily just from 1 good year. If the stock continues to give positive returns and the market continues to hover in the lower state then it for sure would have a negative beta. In that case, adding this stock to any portfolio would help to bring the standard deviation of the portfolio as a whole down, as opposed to not having the negative Beta stock in a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts