Question: I just need help with Part C please (the graph) 1. (24 points) Assume the capital asset pricing model assumptions are satisfied. The expected return

I just need help with Part C please (the graph)

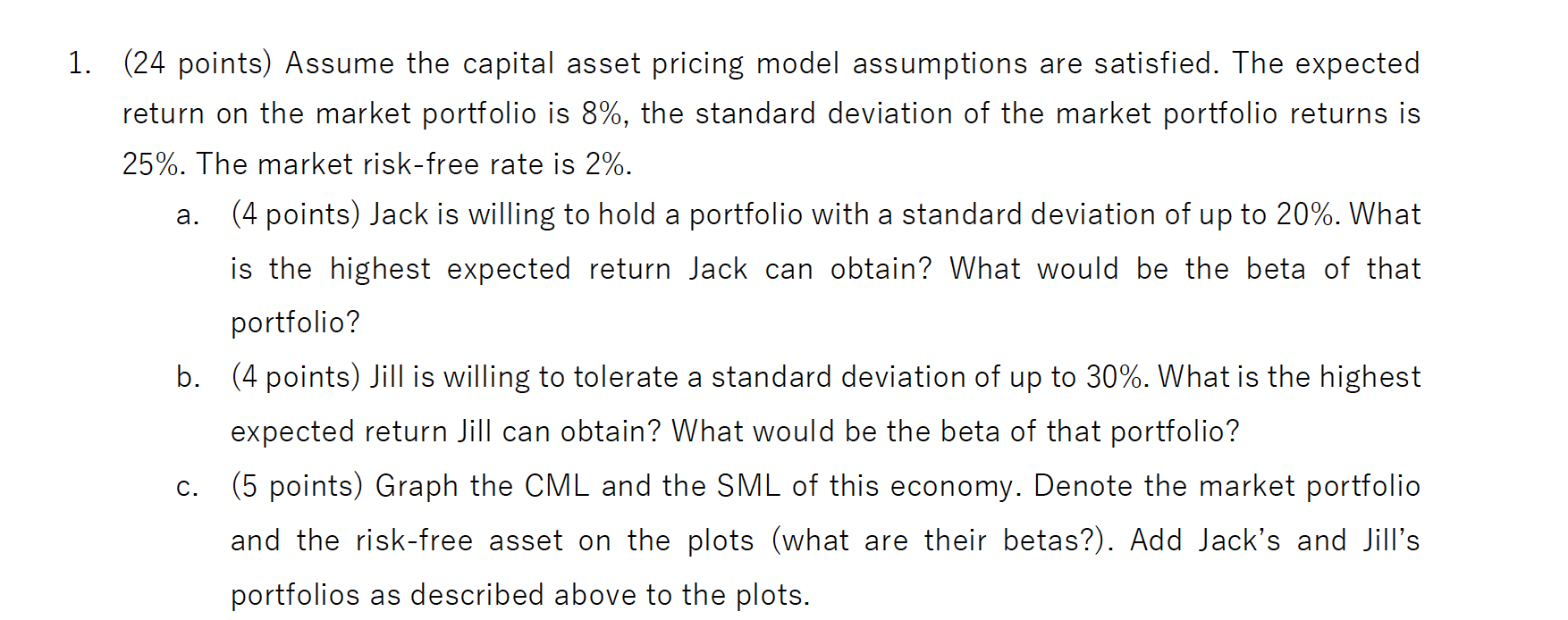

1. (24 points) Assume the capital asset pricing model assumptions are satisfied. The expected return on the market portfolio is 8%, the standard deviation of the market portfolio returns is 25%. The market risk-free rate is 2%. (4 points) Jack is willing to hold a portfolio with a standard deviation of up to 20%. What is the highest expected return Jack can obtain? What would be the beta of that portfolio? a. C. b. (4 points) Jill is willing to tolerate a standard deviation of up to 30%. What is the highest expected return Jill can obtain? What would be the beta of that portfolio? (5 points) Graph the CML and the SML of this economy. Denote the market portfolio and the risk-free asset on the plots (what are their betas?). Add Jack's and Jill's portfolios as described above to the plots. 1. (24 points) Assume the capital asset pricing model assumptions are satisfied. The expected return on the market portfolio is 8%, the standard deviation of the market portfolio returns is 25%. The market risk-free rate is 2%. (4 points) Jack is willing to hold a portfolio with a standard deviation of up to 20%. What is the highest expected return Jack can obtain? What would be the beta of that portfolio? a. C. b. (4 points) Jill is willing to tolerate a standard deviation of up to 30%. What is the highest expected return Jill can obtain? What would be the beta of that portfolio? (5 points) Graph the CML and the SML of this economy. Denote the market portfolio and the risk-free asset on the plots (what are their betas?). Add Jack's and Jill's portfolios as described above to the plots

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts