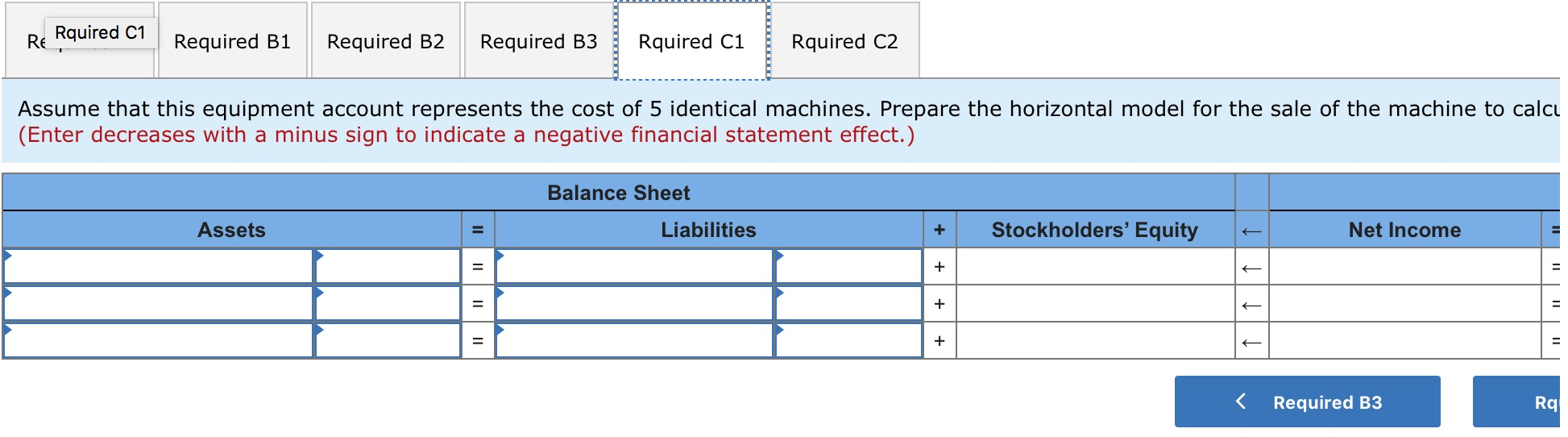

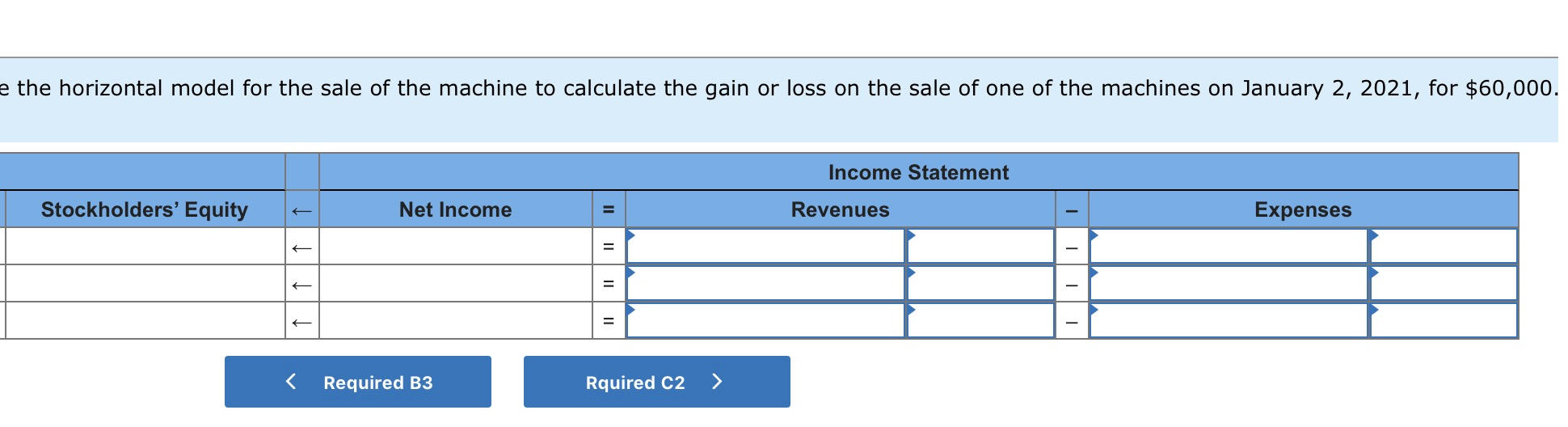

Question: I just need help with part C1 and C2 ***no option to input for stockholder equity. It populates itself*** Options for assets column are accumulated

I just need help with part C1 and C2

***no option to input for stockholder equity. It populates itself***

Options for assets column are accumulated depreciation, cash equipment, gain on sale of equipment, and interest expense. Which I inputted accumulated depreciation(correct) - $54,675 (this number is wrong idk why), Equipment (correct) - $97,200 (this is wrong as well, and cash (correct)- $60,000 (correct)

I am given the option to input for liabilities but I don't know what to put if any.

Revenues and Expenses column options are accumulated depreciation, cash equipment, gain on sale of equipment, and interest expense.

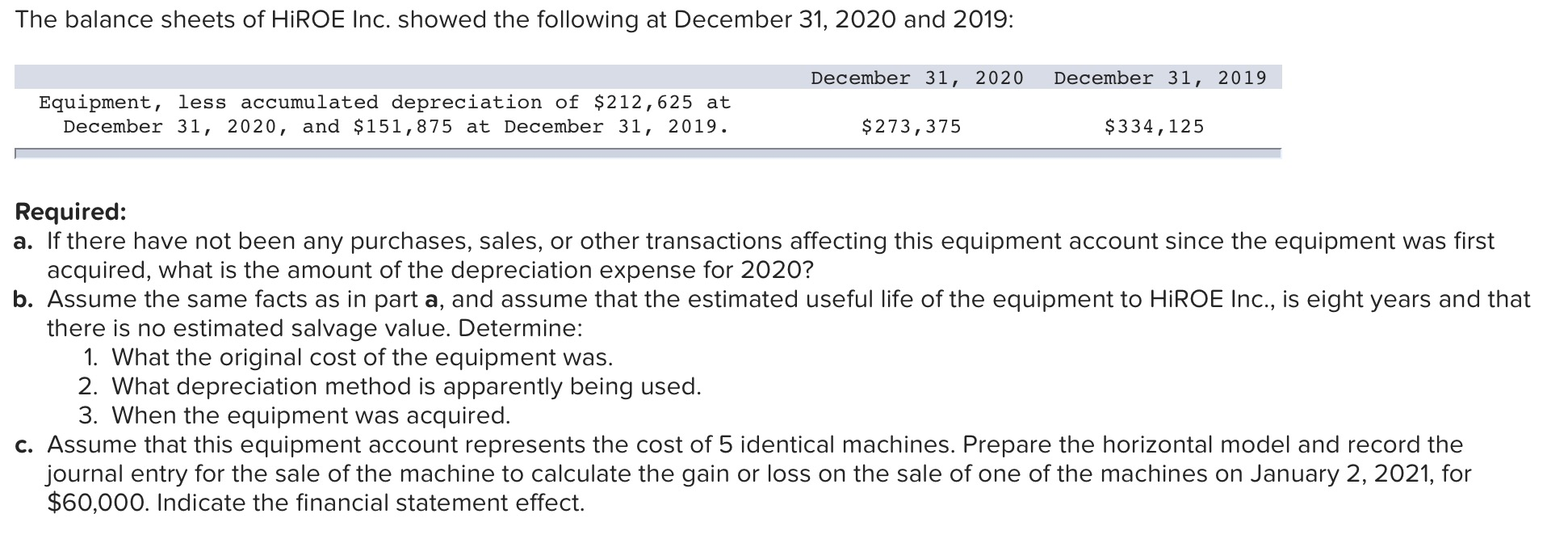

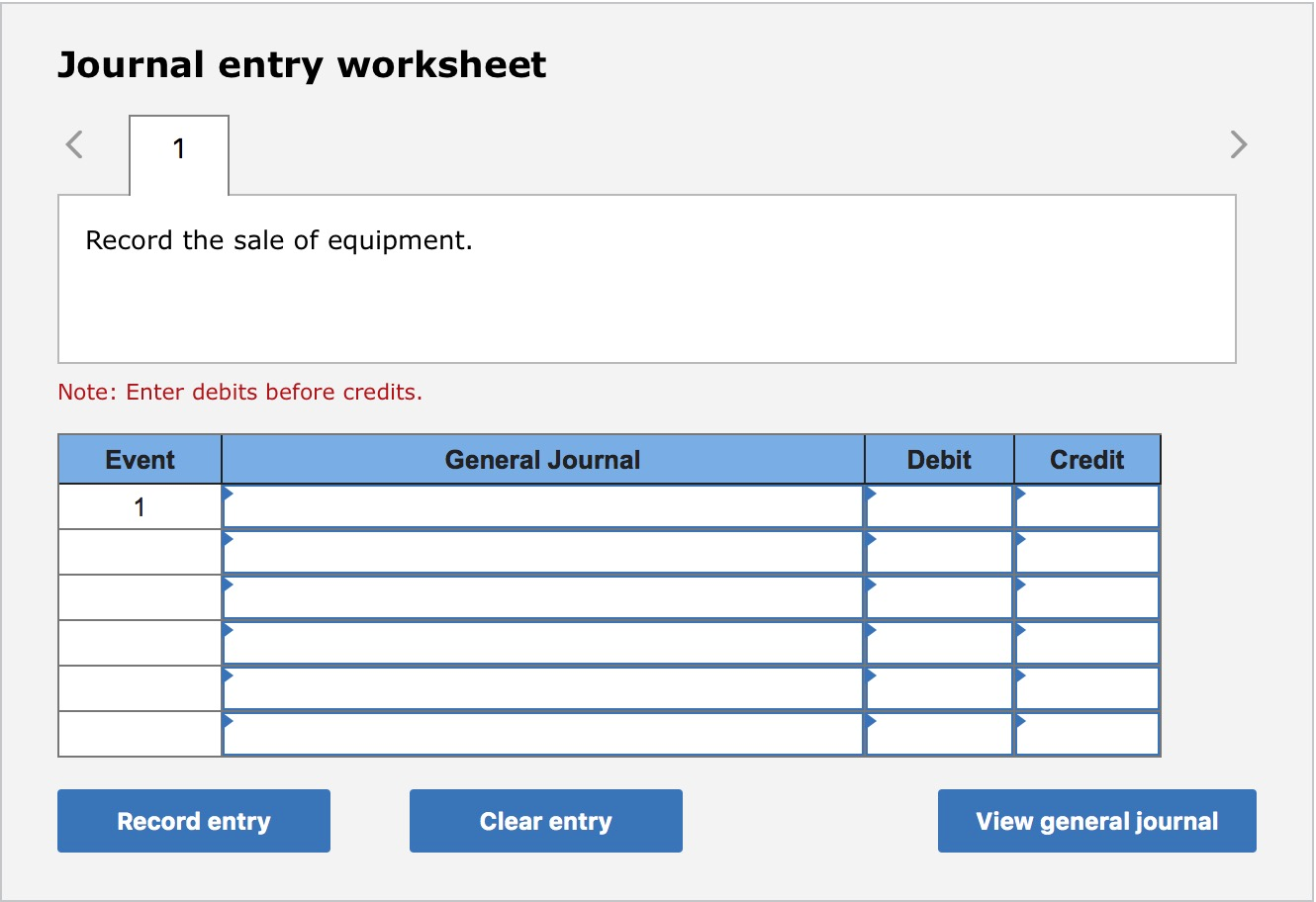

The balance sheets of HiROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. $273, 375 $334,125 Required: a. If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? b. Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HIROE Inc., is eight years and that there is no estimated salvage value. Determine: 1. What the original cost of the equipment was. 2. What depreciation method is apparently being used. 3. When the equipment was acquired. C. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal entry for the sale of the machine to calculate the gain or loss on the sale of one of the machines on January 2, 2021, for $60,000. Indicate the financial statement effect. Required A Required B1 Required B2 Required B3Rquired C1 Rquired C2 Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HIROE Inc., is eight years and that there is no estimated salvage value. Determine what depreciation method is apparently being used? Rquired C1 Required B1 Required B2 Required B3 Rquired C1 Rquired C2 Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model for the sale of the machine to calcu (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Assets Liabilities + Stockholders' Equity Net Income + + III III II + Journal entry worksheet Record the sale of equipment. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts