Question: I just need help with part D please work Problems Save Score: 0 of 10 pts 3 of 24 (2 complete) HW Score: 8.33%, 20

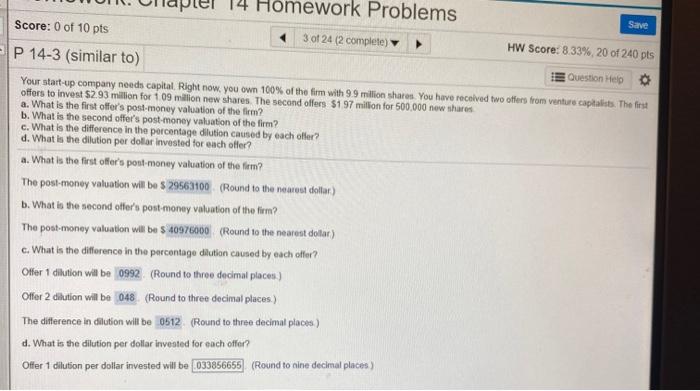

work Problems Save Score: 0 of 10 pts 3 of 24 (2 complete) HW Score: 8.33%, 20 of 240 pts P 14-3 (similar to) Question Help Your start-up company needs capital. Right now, you own 100% of the firm with 99 million shares. You have received two offers from venture capitalists. The first offers to invest $2.93 million for 109 million new shares. The second offers $197 million for 500.000 new shares a. What is the first offer's post-money valuation of the firm? b. What is the second offer's post-money valuation of the firm? c. What is the difference in the percentage dilution caused by each offer? . What is the dilution per dollar invested for each other? a. What is the first offer's post-money valuation of the fem? The post-money valuation will be $ 29563100. (Round to the nearest collar) b. What is the second offer's post monuy valuation of the tim? The post-money valuation will be s 40976000 (Round to the nearest dollar) c. What is the difference in the percentage dilution caused by each offer? Offer 1 dilution will be 0992 (Round to three decimal places) Offer 2 dilution will be 048 (Round to three decimal places.) The difference in dilution will be 0512. Round to three decimal places) d. What is the dilution per dollar invested for each offer? Offer 1 dilution per dollar invested will be 093856656 (Round to nine decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts