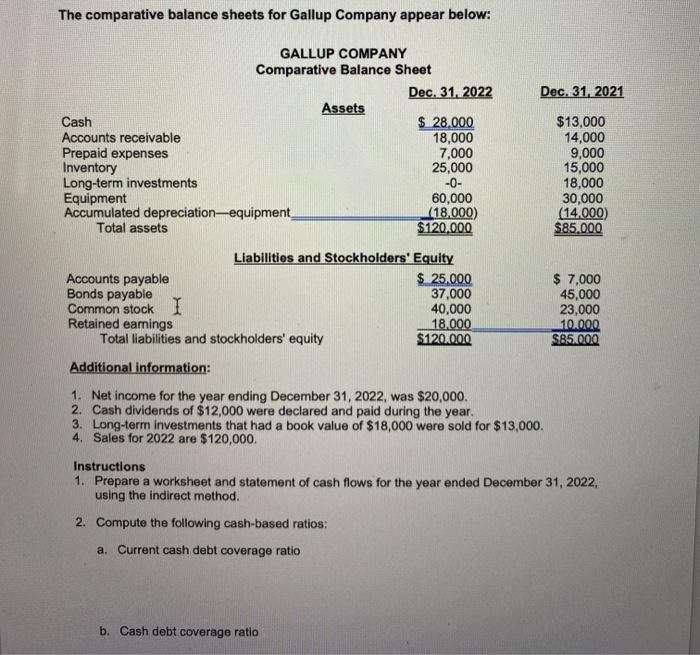

Question: i just need help with problem 1 using the chart pictured below The comparative balance sheets for Gallup Company appear below: Dec. 31, 2021 GALLUP

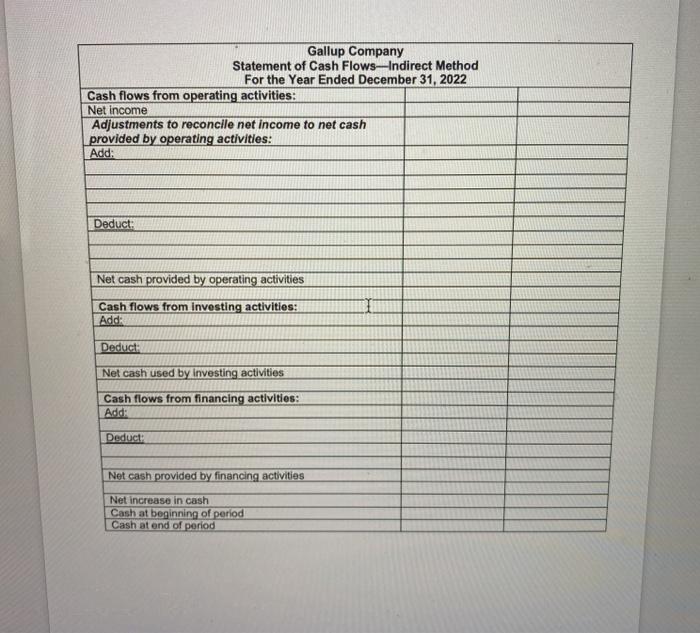

The comparative balance sheets for Gallup Company appear below: Dec. 31, 2021 GALLUP COMPANY Comparative Balance Sheet Dec. 31, 2022 Assets Cash $ 28,000 Accounts receivable 18,000 Prepaid expenses 7,000 Inventory 25,000 Long-term investments -0- Equipment 60,000 Accumulated depreciation-equipment (18.000) Total assets $120.000 $13,000 14,000 9,000 15,000 18,000 30,000 (14.000) $85.000 Liabilities and Stockholders' Equity Accounts payable $ 25.000 Bonds payable 37,000 Common stock I 40,000 Retained earings 18.000 Total liabilities and stockholders' equity $120.000 $ 7,000 45,000 23,000 10.000 $85.000 Additional information: 1. Net income for the year ending December 31, 2022, was $20,000. 2. Cash dividends of $12,000 were declared and paid during the year. 3. Long-term investments that had a book value of $18,000 were sold for $13,000. 4. Sales for 2022 are $120,000 Instructions 1. Prepare a worksheet and statement of cash flows for the year ended December 31, 2022, using the indirect method. 2. Compute the following cash-based ratios: a. Current cash debt coverage ratio b. Cash debt coverage ratio Gallup Company Statement of Cash Flows-Indirect Method For the Year Ended December 31, 2022 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Add: Deduct: Net cash provided by operating activities Cash flows from investing activities: Add: Deduct: Net cash used by Investing activities Cash flows from financing activities: Add: Deduct: Net cash provided by financing activities Net increase in cash Cash at beginning of period Cash at end of period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts