Question: I just need help with the dollar amounts for each marked in red. so for 2A its on part 4, then for 2B its also

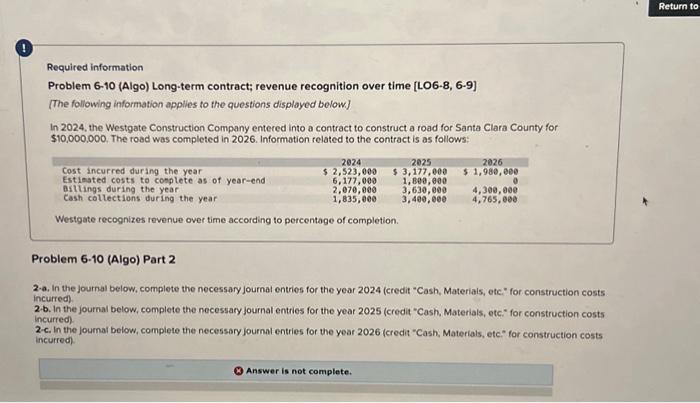

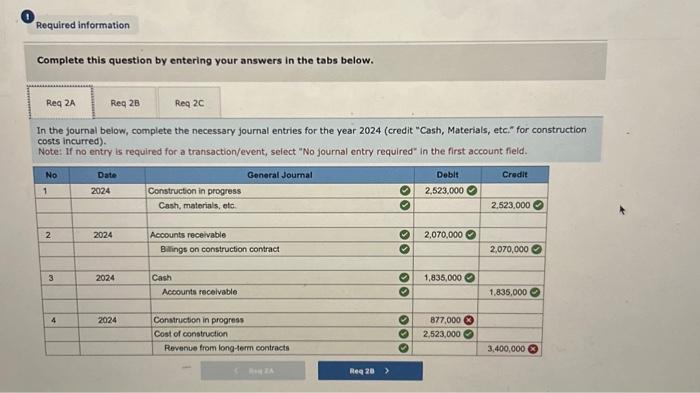

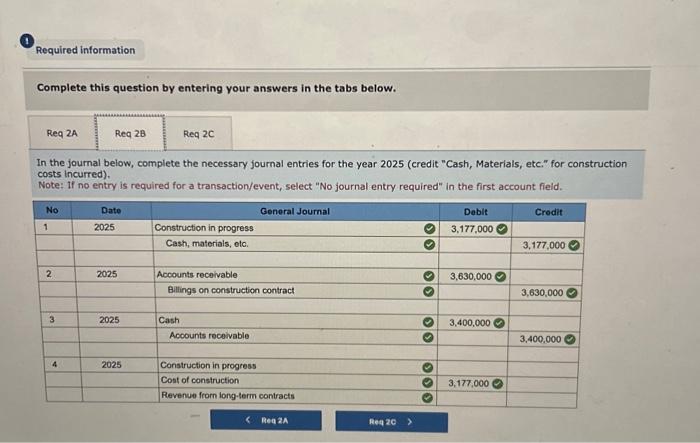

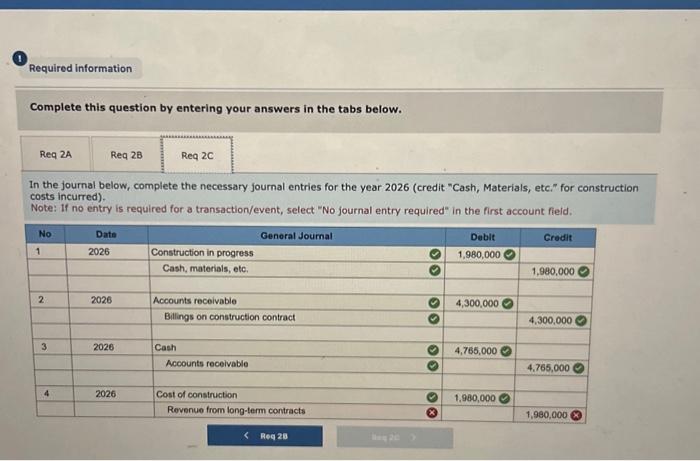

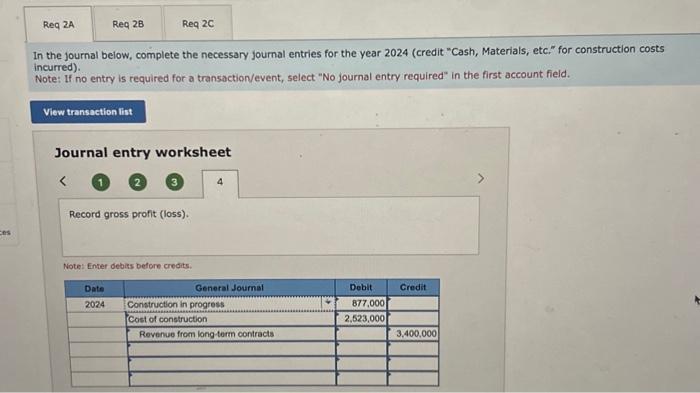

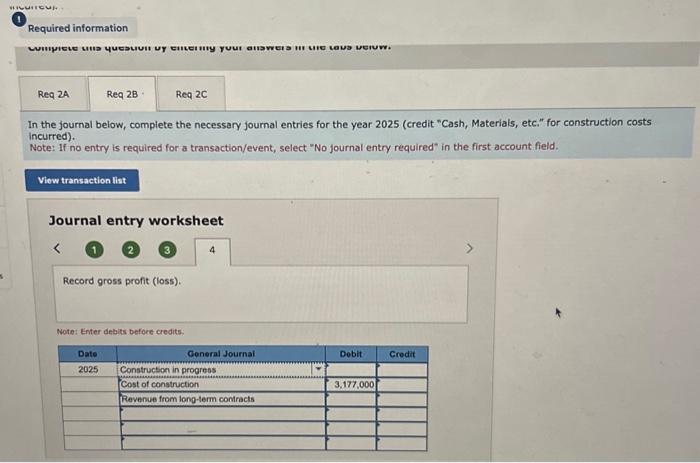

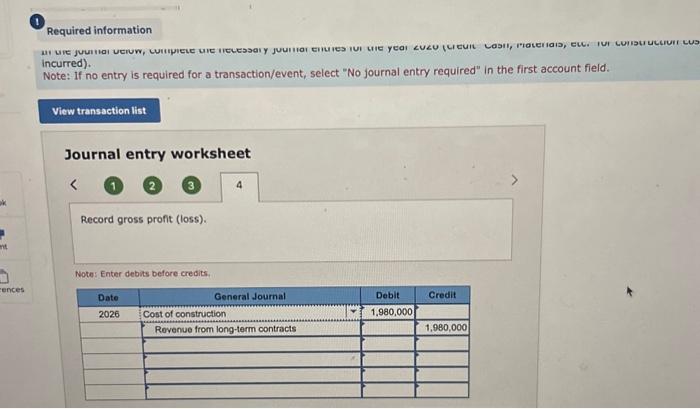

In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc," for construction costs incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 1. (3) Record gross profit (loss). Note: Enter debiss before credits. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Complete this question by entering your answers in the tabs below. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Complete this question by entering your answers in the tabs below. In the journal below, complete the necessary journal entries for the year 2026 (credit "Cash, Materials, etc." for construction costs incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid. Required information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026 . Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. Problem 6.10 (Algo) Part 2 2.a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2.b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). 2c. In the journal below, complete the necessary journal entries for the year 2026 (credit "Cash, Materials, etc." for construction costs incurred). Complete this question by entering your answers in the tabs below. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts