Question: I just need help with the last one, e. (3), but I included everything else so you know what is being talked about. Please use

I just need help with the last one, e. (3), but I included everything else so you know what is being talked about. Please use excel to show work!

I just need help with the last one, e. (3), but I included everything else so you know what is being talked about. Please use excel to show work!

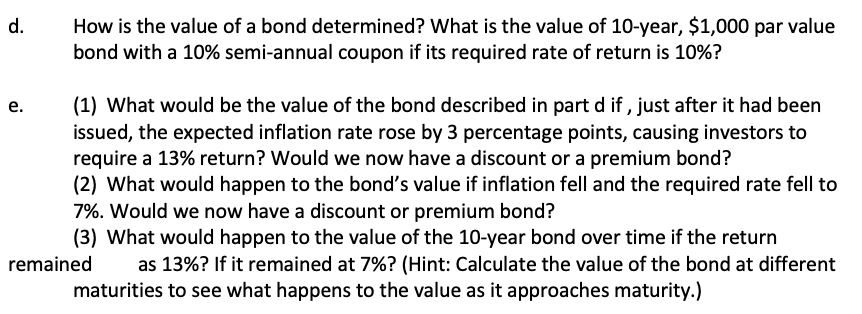

d. How is the value of a bond determined? What is the value of 10-year, $1,000 par value bond with a 10% semi-annual coupon if its required rate of return is 10%? e. (1) What would be the value of the bond described in part d if, just after it had been issued, the expected inflation rate rose by 3 percentage points, causing investors to require a 13% return? Would we now have a discount or a premium bond? (2) What would happen to the bond's value if inflation fell and the required rate fell to 7%. Would we now have a discount or premium bond? (3) What would happen to the value of the 10-year bond over time if the return remained as 13%? If it remained at 7%? (Hint: Calculate the value of the bond at different maturities to see what happens to the value as it approaches maturity.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts