Question: i just need part b done and explained 10. Laurel Street, president of Uvalde Manufacturing Inc., is preparing a proposal to present to her board

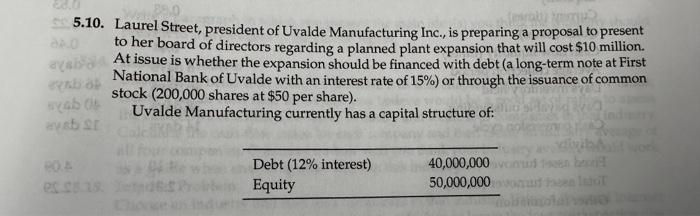

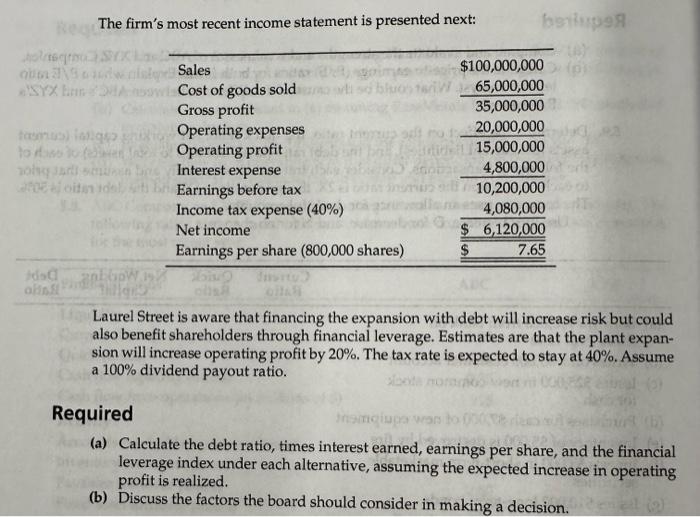

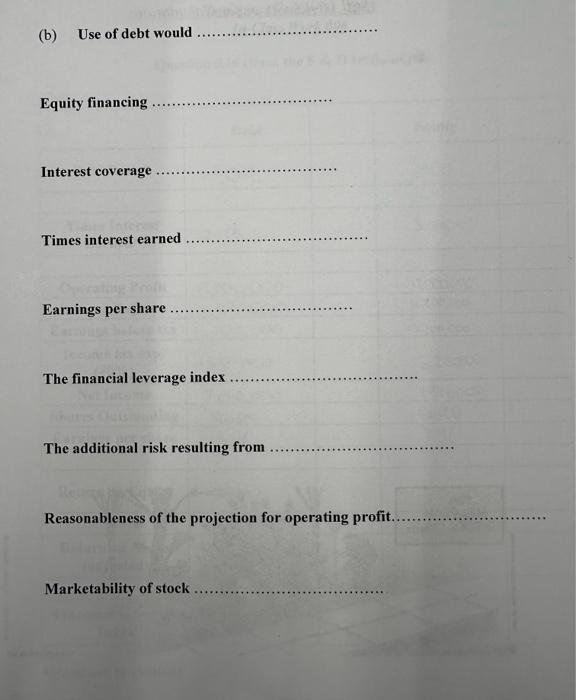

10. Laurel Street, president of Uvalde Manufacturing Inc., is preparing a proposal to present to her board of directors regarding a planned plant expansion that will cost $10 million. At issue is whether the expansion should be financed with debt (a long-term note at First National Bank of Uvalde with an interest rate of 15% ) or through the issuance of common stock (200,000 shares at $50 per share). Uvalde Manufacturing currently has a capital structure of: The firm's most recent income statement is presented next: Laurel Street is aware that financing the expansion with debt will increase risk but could also benefit shareholders through financial leverage. Estimates are that the plant expansion will increase operating profit by 20%. The tax rate is expected to stay at 40%. Assume a 100% dividend payout ratio. Required (a) Calculate the debt ratio, times interest earned, earnings per share, and the financial leverage index under each alternative, assuming the expected increase in operating profit is realized. (b) Discuss the factors the board should consider in making a decision. (b) Use of debt would Equity financing Interest coverage Times interest earned Earnings per share The financial leverage index The additional risk resulting from Reasonableness of the projection for operating profit. Marketability of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts