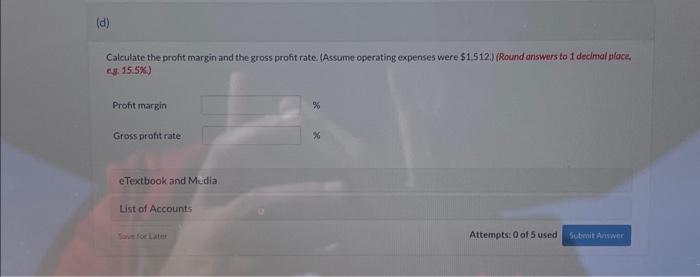

Question: i just need part d ( caculate the profit margin and the gross profit rate) enter Ofor the anounts Credit account tites are automatically indented

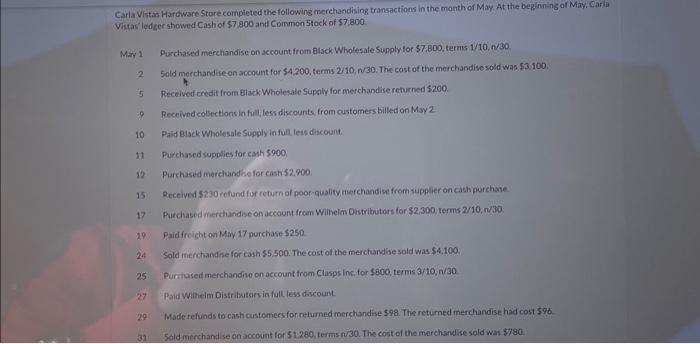

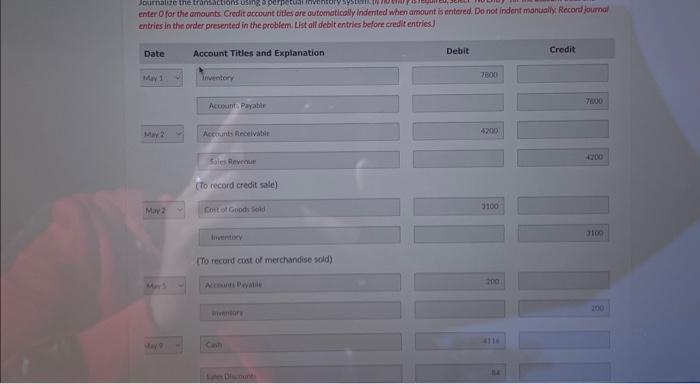

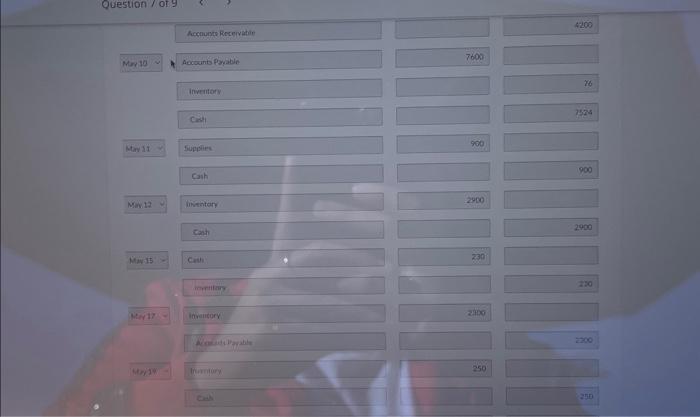

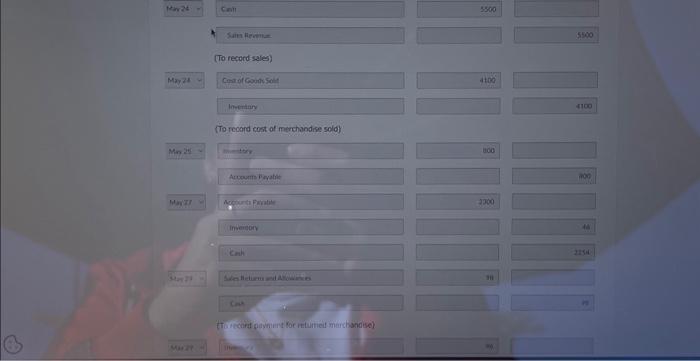

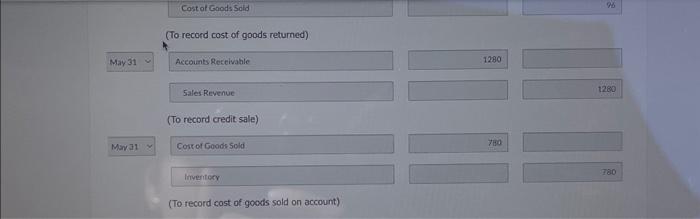

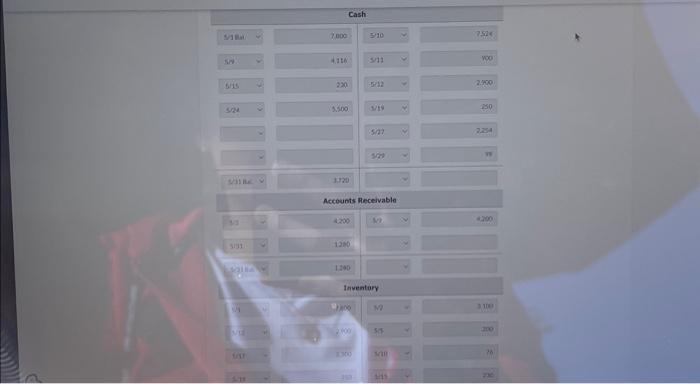

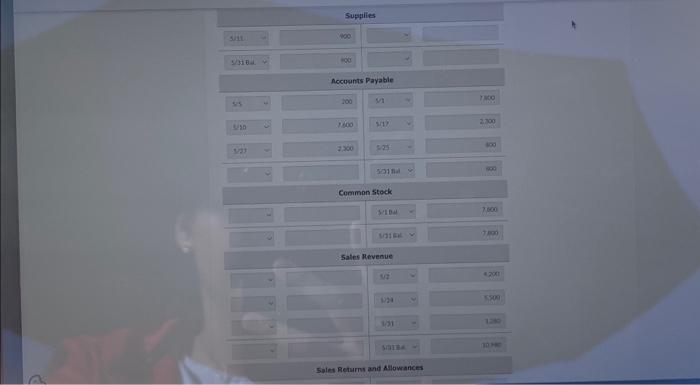

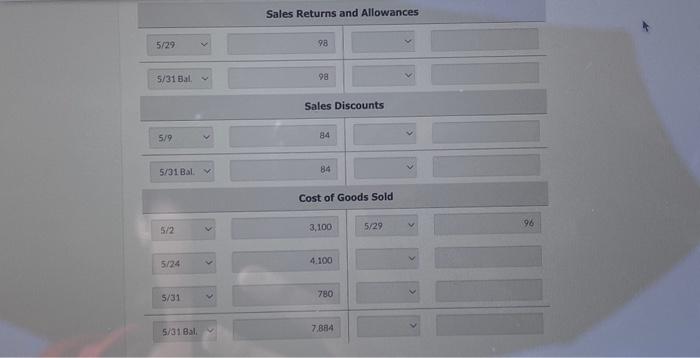

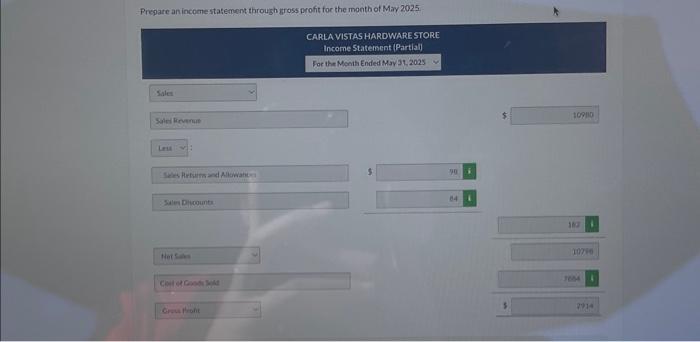

enter Ofor the anounts Credit account tites are automatically indented when amount is entered. Do not indent mancalily Recond journal entries in the order presented in the problem List ali debit entries before credit entries. Prepate an incomestatement through gross profit for the month of May 2025 Sales Returns and Allowances \begin{tabular}{|l|l|l|} \hline 5/29 & 98 & \\ \hline 5/31 Bal. & 98 & \\ \hline \end{tabular} Sales Discounts Calculate the profit margin and the gross profit rate. (Assume operating expenses were $1.512 ) (Round answers to 1 decimal place, c.s. 15.5\%) Profit margin % Gross profit rate eTextbook and Media Cost of Goods Sold (To record cost of goods returned) Accounts Rectivatile Sales Revenue (To record credit sale) Mara1 (To record cost of goods sold on account) Carla Vistas Hartware Store completed the following merehandising transactions in the monthor May At the beginning of May. Carib Vistas ledger showed Cash of $7,800 and Common 5 tock of $7,800. Mar 1 Purchased merchandise on account from Black Wholesale Supply for 37,800 , terms 1/10,n/30. 2 Sold merchandese on account for $4,200, terms 2/10, n/30. The cost of the merchandise sold was $3,100, 5 Recelved credit from Black Wholesale Supply for merchandise returned 5200. 9. Recrived colbections in full less discounts, from customers billed on Msy 2 10 Paid elack Wholesale Supply in fult less discount. 11 Purchased supplies tor cash 5900 12 Purchased merchundise for cash 52.%00. 15 Preceived 5230 refund fur retum of poor-quality merchandise fromsupplier on cash purchase 17 Purchased merchandise on account from Wilhelm Distributors for $2,300, terms 2/10,n/30. 19. Paidfreight on May 17 purchave $250 24 Sold inerchandise for cash $5,500. The cost of the merchandise sold was $4,100 25. Purchased merchandise on account from Clusps Inc, for $800, termis 3/10,n/30 27 Paid Wihieim Distributors in full less discount. 29. Made refunds to casticustomees for retumed merchandise 598 . The returned merchandise had cost 596 31. Sold merchand se on account for 51280 . terms N30. The cost of the merchandise sold was $780. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Common stock } \\ \hline & & = & 7000 \\ \hline 3 & Maske & & \\ \hline \multicolumn{4}{|c|}{ Sales Revenue } \\ \hline & & & \\ \hline 7 & var & & \\ \hline 8 & & = & 1200 \\ \hline 3 & saite & & ante \\ \hline \end{tabular} Soles Returms and Allowances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts