Question: I just need question 4. I couldn't find an answer in my book so I went looking online. I think its true but dont know.

I just need question 4. I couldn't find an answer in my book so I went looking online. I think its true but dont know. Can someone confirm it's true and give me an explanation? Thanks in advance!

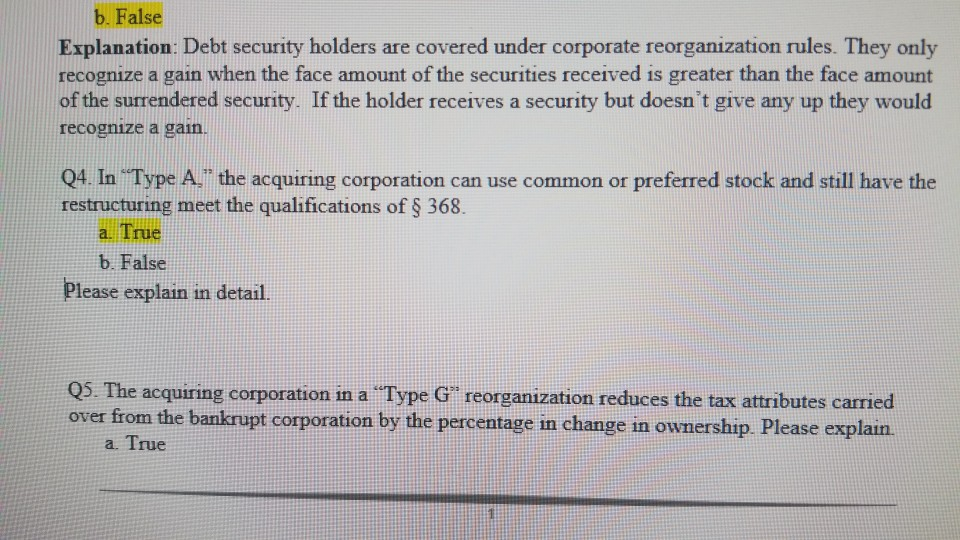

b. False Explanation: Debt security holders are covered under corporate reorganization rules. They only recognize a gain when the face amount of the securities received is greater than the face amount of the surrendered security. If the holder receives a security but doesn't give any up they would recognize a gain. Q4. In "Type A, the acquiring corporation can use common or preferred stock and still have the restructuring meet the qualifications of 368. a. True b. False Please explain in detail. Q5. The acquiring corporation in a "Type G reorganization reduces the tax attributes carried over from the bankrupt corporation by the percentage in change in ownership. Please explain a. True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts