Question: I just need some help on this last part please! I will rate! Many thanks and God bless! Debit Credit a. Used office supplies of

I just need some help on this last part please!

I just need some help on this last part please!

I will rate!

Many thanks and God bless!

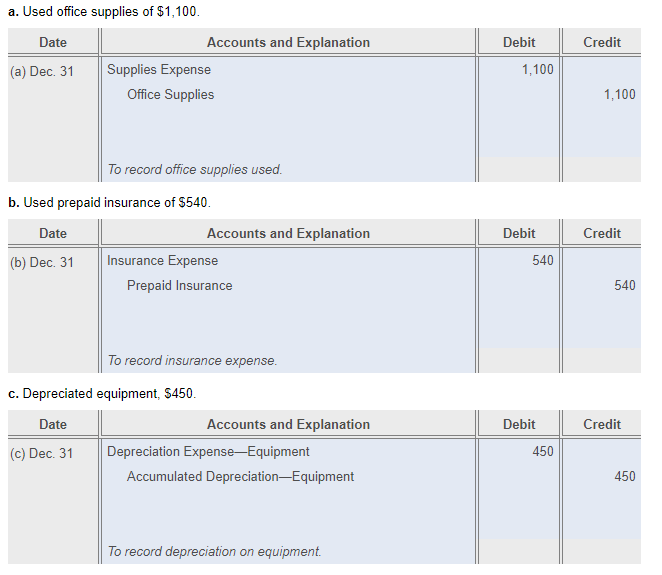

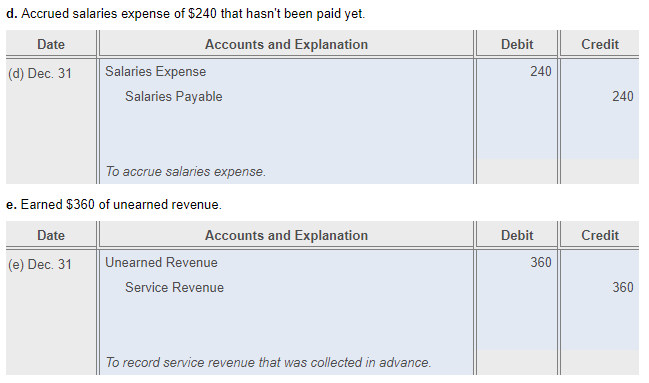

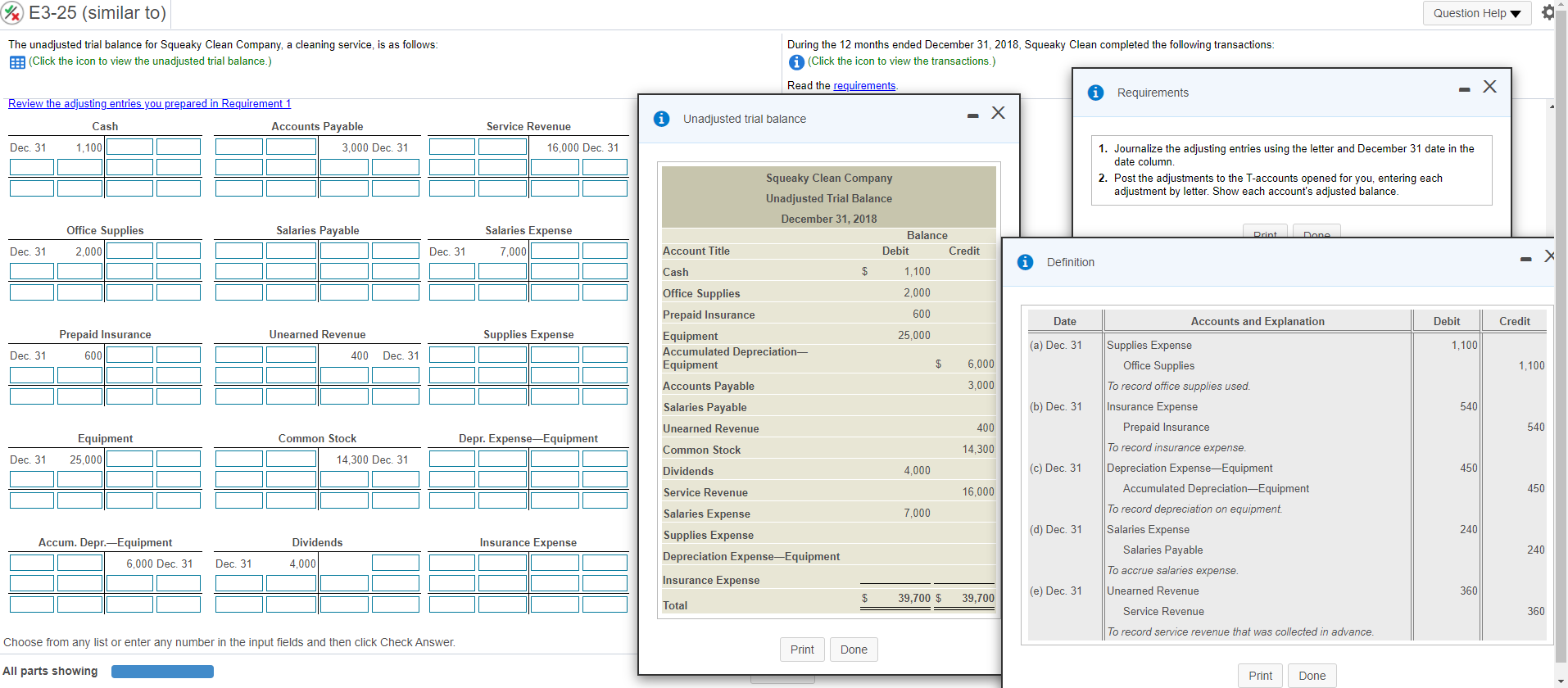

Debit Credit a. Used office supplies of $1,100. Date Accounts and Explanation (a) Dec. 31 Supplies Expense Office Supplies 1,100 1,100 To record office supplies used. Debit Credit b. Used prepaid insurance of $540. Date Accounts and Explanation (b) Dec. 31 Insurance Expense Prepaid Insurance 540 540 To record insurance expense. Debit Credit c. Depreciated equipment, $450. Date Accounts and Explanation (c) Dec. 31 Depreciation Expense-Equipment Accumulated Depreciation-Equipment 450 450 To record depreciation on equipment Date Credit d. Accrued salaries expense of $240 that hasn't been paid yet. Accounts and Explanation (d) Dec. 31 Salaries Expense Salaries Payable Debit 240 240 To accrue salaries expense. Debit Credit e. Earned $360 of unearned revenue. Date Accounts and Explanation (e) Dec. 31 Unearned Revenue Service Revenue 360 360 To record service revenue that was collected in advance. E3-25 (similar to) Question Help o The unadjusted trial balance for Squeaky Clean Company, a cleaning service, is as follows: E (Click the icon to view the unadjusted trial balance.) During the 12 months ended December 31, 2018, Squeaky clean completed the following transactions: (Click the icon to view the transactions.) Read the requirements . X Requirements Review the adjusting entries you prepared in Requirement 1 Cash Accounts Payable Dec. 31 1.100 3.000 Dec. 31 Service Revenue Unadjusted trial balance 16,000 Dec. 31 1. Journalize the adjusting entries using the letter and December 31 date in the date column. 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance Squeaky Clean Company Unadjusted Trial Balance December 31, 2018 Balance Debit Credit Office Supplies Salaries Payable Print Dane Salaries Expense 7,000 Dec. 31 2,000 Dec. 31 Account Title Definition Cash $ 1.100 2.000 600 Date Debit Credit Unearned Revenue Supplies Expense 25,000 Prepaid Insurance 600 (a) Dec. 31 1,100 Dec. 31 400 Dec. 31 Office Supplies Prepaid Insurance Equipment Accumulated Depreciation- Equipment Accounts Payable Salaries Payable Unearned Revenue $ 6.000 1,100 3,000 (b) Dec. 31 540 400 540 Common Stock Depr. Expense-Equipment Equipment 25,000 Accounts and Explanation Supplies Expense Office Supplies To record office supplies used. Insurance Expense Prepaid Insurance To record insurance expense. Depreciation Expense-Equipment Accumulated Depreciation Equipment To record depreciation on equipment. Salaries Expense Salaries Payable Common Stock 14,300 Dec. 31 14,300 Dec. 31 Dividends 4,000 (c) Dec. 31 450 16,000 450 7,000 (d) Dec. 31 240 Dividends Insurance Expense Accum. Depr.-Equipment 6.000 Dec. 31 Service Revenue Salaries Expense Supplies Expense Depreciation Expense-Equipment Insurance Expense 240 Dec. 31 4.000 To accrue salaries expense. (e) Dec. 31 Unearned Revenue 360 $ 39,700 $ 39,700 Total Service Revenue 360 To record service revenue that was collected in advance. Choose from any list or enter any number in the input fields and then click Check Answer. Print Done All parts showing Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts