Question: I just need the answer for part (b). I have posted part (a) for reference On January 1, 2021, Pearl Corporation acquired 150,000 common shares

I just need the answer for part (b). I have posted part (a) for reference

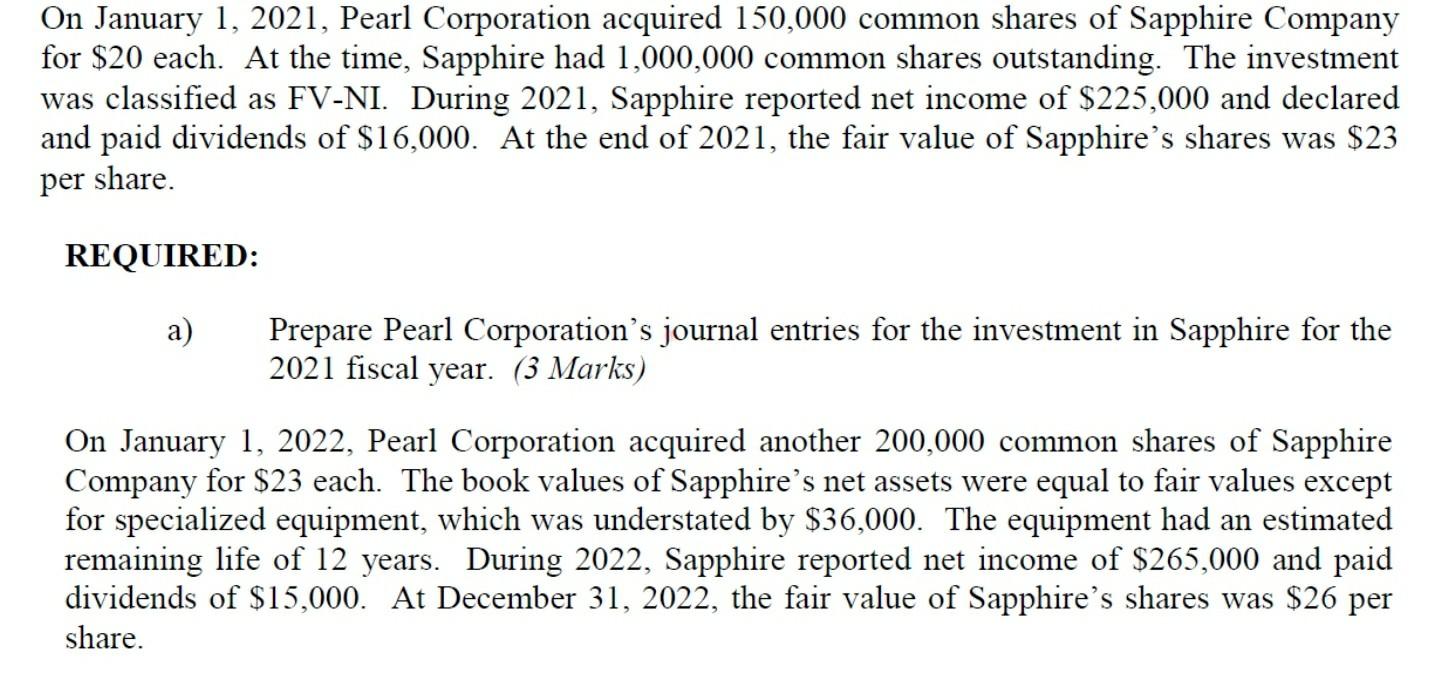

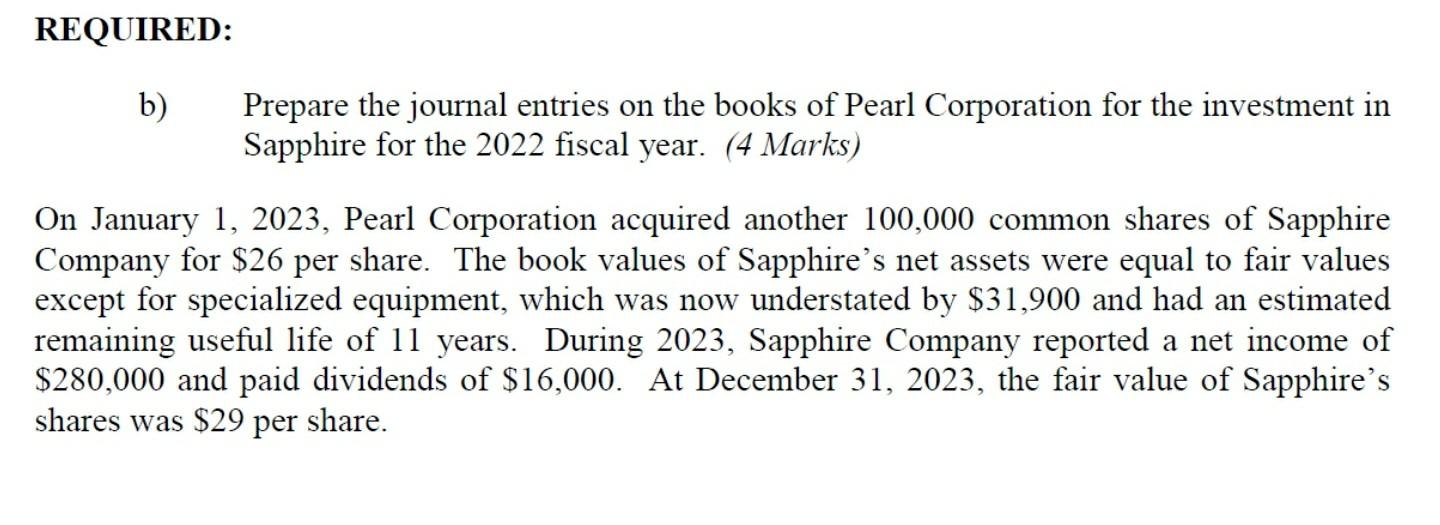

On January 1, 2021, Pearl Corporation acquired 150,000 common shares of Sapphire Company for $20 each. At the time, Sapphire had 1,000,000 common shares outstanding. The investment was classified as FV-NI. During 2021, Sapphire reported net income of $225,000 and declared and paid dividends of $16,000. At the end of 2021, the fair value of Sapphire's shares was $23 per share. REQUIRED: a) Prepare Pearl Corporation's journal entries for the investment in Sapphire for the 2021 fiscal year. (3 Marks) On January 1, 2022, Pearl Corporation acquired another 200,000 common shares of Sapphire Company for $23 each. The book values of Sapphire's net assets were equal to fair values except for specialized equipment, which was understated by $36,000. The equipment had an estimated remaining life of 12 years. During 2022, Sapphire reported net income of $265,000 and paid dividends of $15,000. At December 31, 2022, the fair value of Sapphire's shares was $26 per share. REQUIRED: b) Prepare the journal entries on the books of Pearl Corporation for the investment in Sapphire for the 2022 fiscal year. (4 Marks) On January 1, 2023, Pearl Corporation acquired another 100,000 common shares of Sapphire Company for $26 per share. The book values of Sapphire's net assets were equal to fair values except for specialized equipment, which was now understated by $31,900 and had an estimated remaining useful life of 11 years. During 2023, Sapphire Company reported a net income of $280,000 and paid dividends of $16,000. At December 31, 2023, the fair value of Sapphire's shares was $29 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts