Question: I just need the answer to part a Immunization is a way to control interest rate risk that is widely used by pension funds, insurance

I just need the answer to part a

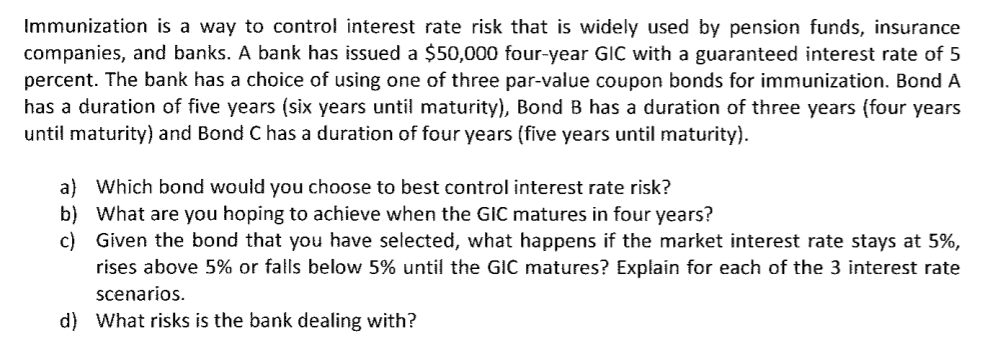

Immunization is a way to control interest rate risk that is widely used by pension funds, insurance companies, and banks. A bank has issued a $50,000 four-year GIC with a guaranteed interest rate of 5 percent. The bank has a choice of using one of three par-value coupon bonds for immunization. Bond A has a duration of five years (six years until maturity), Bond B has a duration of three years (four years until maturity) and Bond C has a duration of four years (five years until maturity). Which bond would you choose to best control interest rate risk? What are you hoping to achieve when the GIC matures in four years? Given the bond that you have selected, what happens if the market interest rate stays at 5%, rises above 5% or falls below 5% until the GIC matures? Explain for each of the 3 interest rate scenariOS What risks is the bank dealing with? a) b) c) d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts