Question: I just need the answer to part d. On January 1, 2026, Wildhorse Corp, had 461,000 shares of common stock outstanding. During 2026, it had

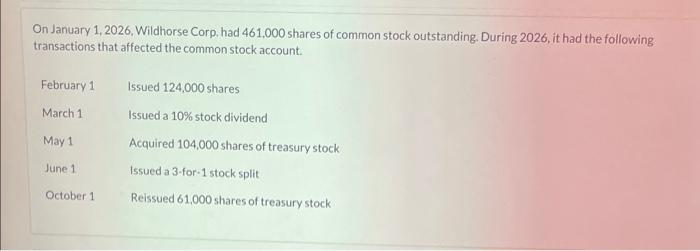

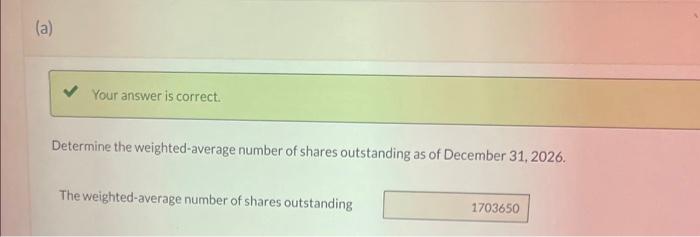

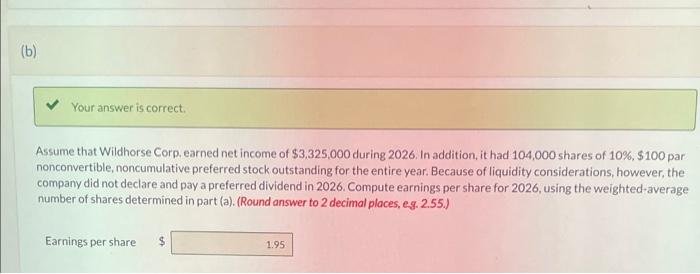

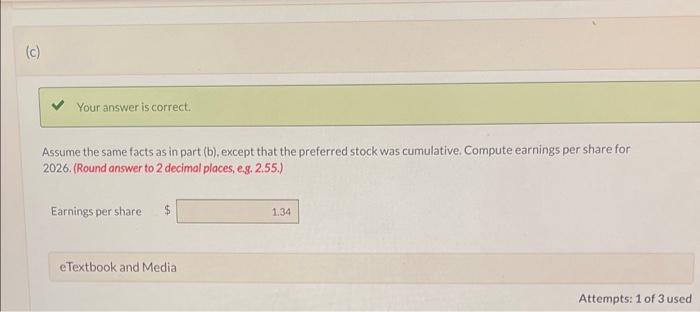

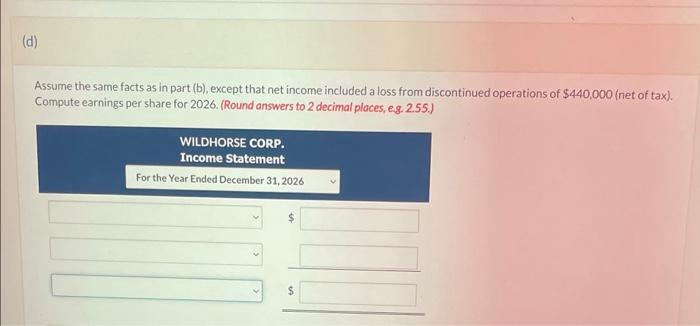

On January 1, 2026, Wildhorse Corp, had 461,000 shares of common stock outstanding. During 2026, it had the following transactions that affected the common stock account. Determine the weighted-average number of shares outstanding as of December 31, 2026. The weighted-average number of shares outstanding Assume that Wildhorse Corp, earned net income of $3,325,000 during 2026. In addition, it had 104,000 shares of 10%,$100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2026. Compute earnings per share for 2026, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, eg. 2.55.) Earnings per share $ Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earning5 per share for 2026. (Round answer to 2 decimal places, es. 2.55.) Earningsper share Assume the same facts as in part (b), except that net income included a loss from discontinued operations of $440,000 (net of tax). Compute earnings per share for 2026. (Round answers to 2 decimal ploces, eg. 2.55.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts