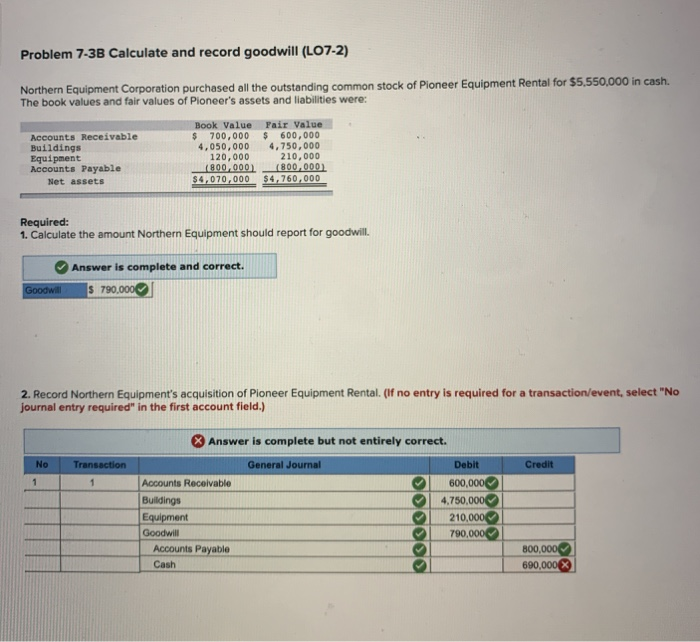

Question: i just need the answer to second part. I don't know what else I have to add to journal entry. Problem 7-3B Calculate and record

Problem 7-3B Calculate and record goodwill (LO7-2) Northern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental for $5,550,000 in cash. The book values and fair values of Pioneer's assets and liabilities were: Book Value $ 700,000 4,050,000 120,000 (800,000) $4,070,000 Fair Value $ 600,000 4,750,000 210,000 (800,000) $4,760,000 Accounts Receivable Buildings Equipment Accounts Payable Net assets Required: 1. Calculate the amount Northern Equipment should report for goodwill. Answer is complete and correct. $ 790,000 Goodwill 2. Record Northern Equipment's acquisition of Pioneer Equipment Rental. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Credit Transaction General Journal Debit 600,0000 Accounts Receivable 1 4,750,0000 Buildings Equipment 210,000 790,000 Goodwill Accounts Payable 800,000 690,000x) Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts