Question: I just need the correct answer for part B. Any help will be liked! Nicole's employer, Poe Corporation, provides her with an automobile allowance of

I just need the correct answer for part B. Any help will be liked!

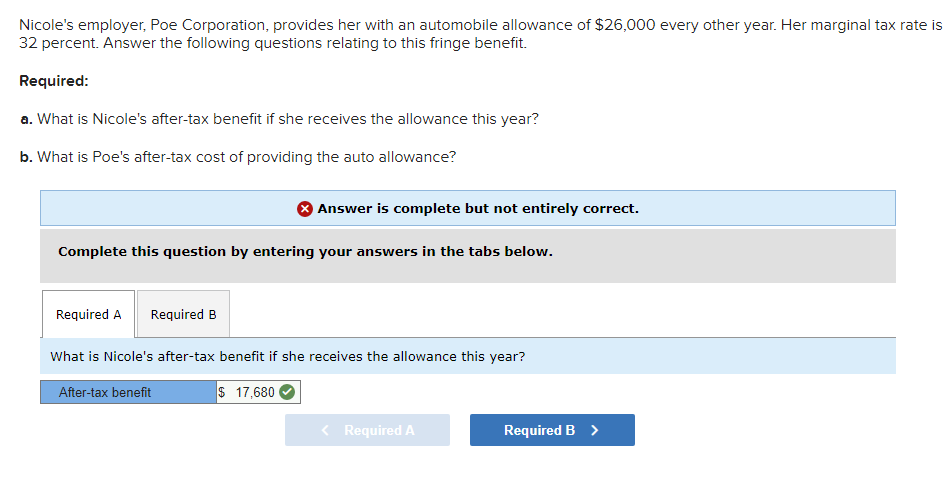

Nicole's employer, Poe Corporation, provides her with an automobile allowance of $26,000 every other year. Her marginal tax rate is 32 percent. Answer the following questions relating to this fringe benefit. Required: a. What is Nicole's after-tax benefit if she receives the allowance this year? b. What is Poe's after-tax cost of providing the auto allowance? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is Nicole's after-tax benefit if she receives the allowance this year? What is Poe's after-tax cost of providing the auto allowance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts