Question: I just need the journal entries, please help ASAP During June 202X, the business completed these transactions: June 1: Received cash of $9900 and issued

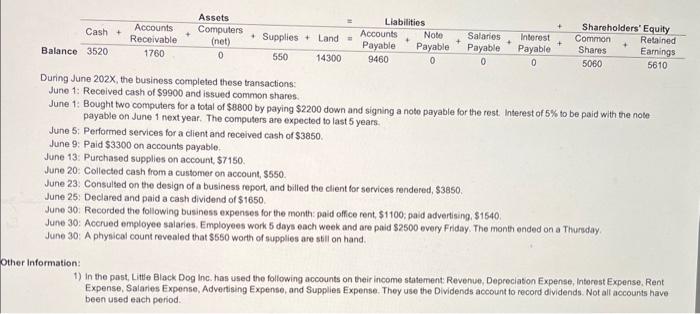

During June 202X, the business completed these transactions: June 1: Received cash of $9900 and issued common shares. June 1: Bought two computers for a total of $8800 by paying $2200 down and signing a note payable for the rest. Interest of 5% to be paid with the note payable on June 1 next year. The computers are expected to last 5 years. June 5 : Performed services for a client and recelved cash of $3850. June 9: Paid \$3300 on accounts payable. June 13: Purchased supplies on account, $7150. June 20: Collected cash from a customer on account, $550. June 23. Consulted on the design of a business report, and billed the client for services rendered, $3850. June 25: Declared and paid a cash dividend of $1650. June 30: Recorded the following business expenses for the month: pald office rent, $1100; paid advertising, $1540. June 30: Accrued employee salaries. Employees work 5 days each week and are paid $2500 every Friday. The month ended on a Thureday. June 30: A phynical count revealed that $550 worth of supplies are stil on hand. Information: 1) In the past, Litte Black Dog Inc. has used the following accounts on their income statement: Revenue, Depreciaton Expense, Interest Expense. Rent Expense, Salaries Expense, Advertising Expenso, and Supplies Expense. They use the Dividends account to record dividends. Not alf accounts have been used each period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts