Question: i keep asking this question one too many times for it to be always wrong Grand Champion Inc. purchased America's Sweethearts Corporation on January 1,

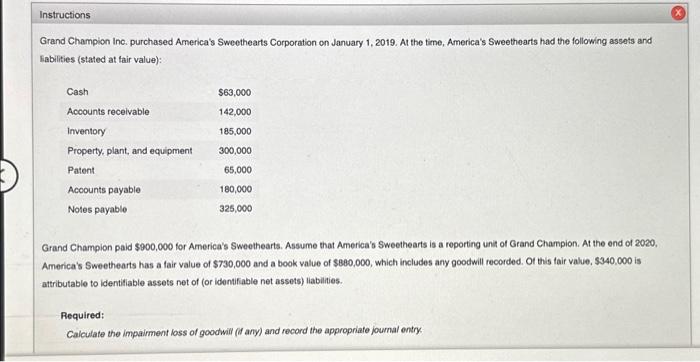

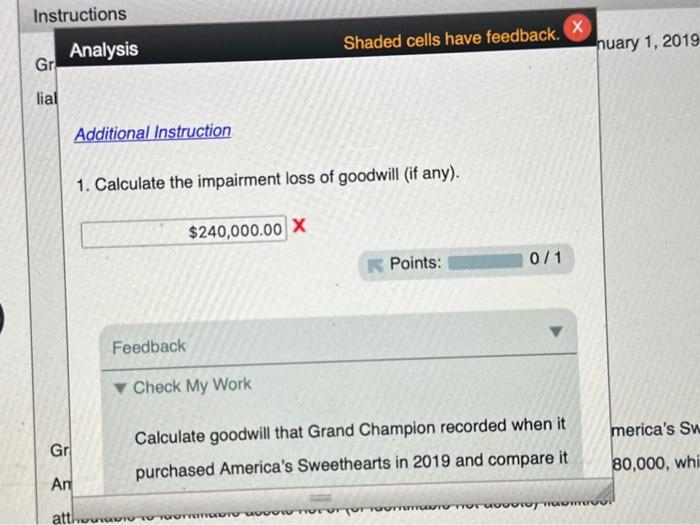

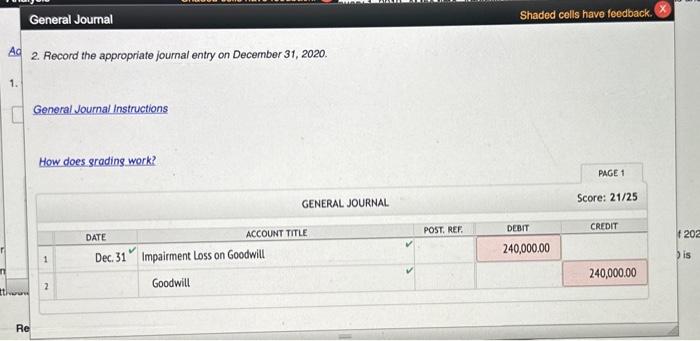

Grand Champion Inc. purchased America's Sweethearts Corporation on January 1, 2019. At the time, America's Sweethearts had the following assats and Eabilities (stated at tair value): Grand Champion paid $900,000 for America's Sweethearts. Assume that America's Sweethearts is a reporting unit of Grand Champion. At the end of 2020. America's Sweethearts has a fair value of $730,000 and a book value of $880,000, which includes any goodwill recorded. Of this fair value, $340,000 is attributable to identifiable assets net of (or identifiable net assets) liabilities. Required: Calculate the impairment loss of goodwill (ff any) and record the appropriate journal entry. 1. Calculate the impairment loss of goodwill (if any). x Feedback Check My Work Calculate goodwill that Grand Champion recorded when it purchased America's Sweethearts in 2019 and compare it 2. Record the appropriate journal entry on December 31, 2020. General Journal instructions How does sradins work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts