Question: I keep failing number 4 Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern

I keep failing number 4

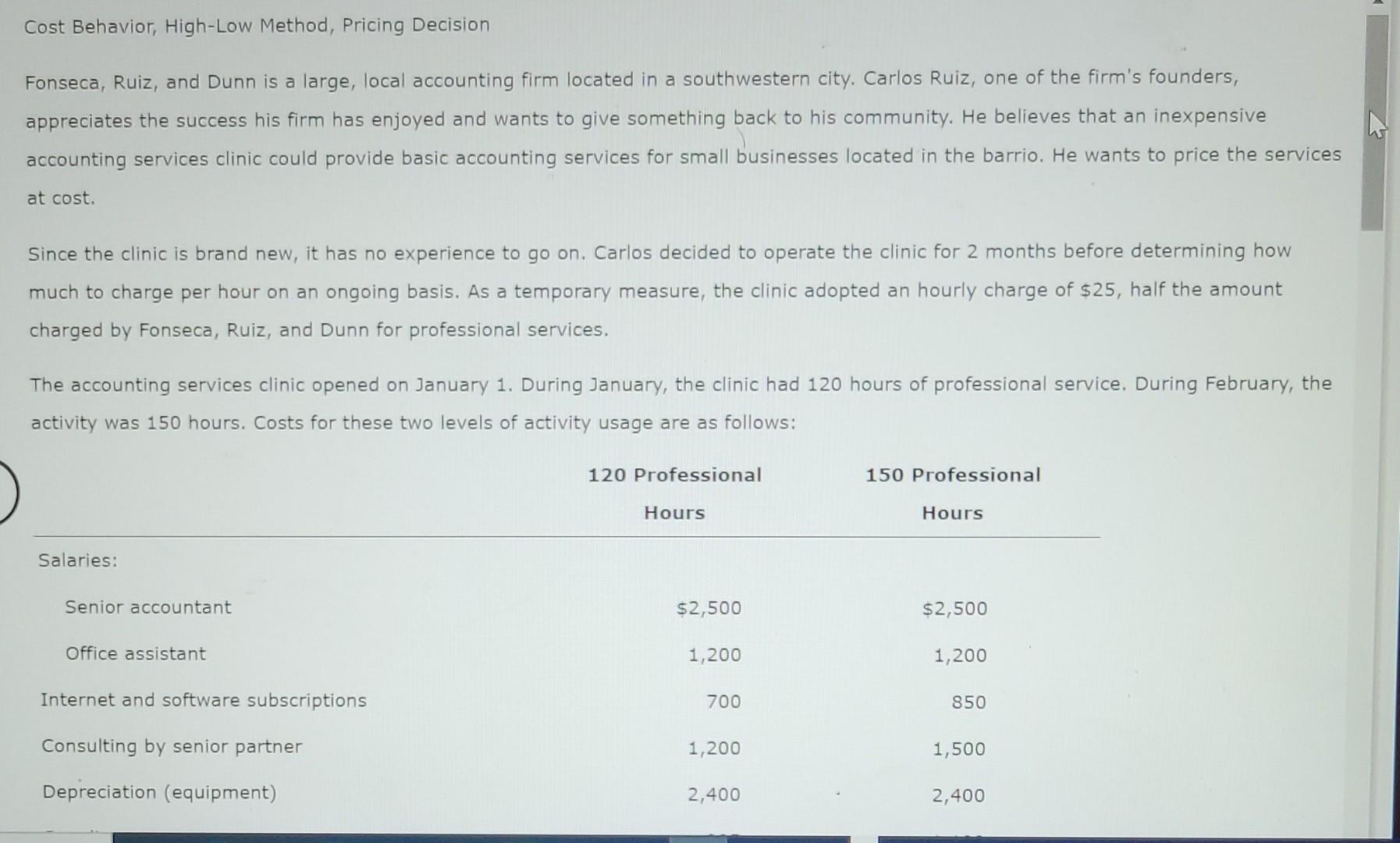

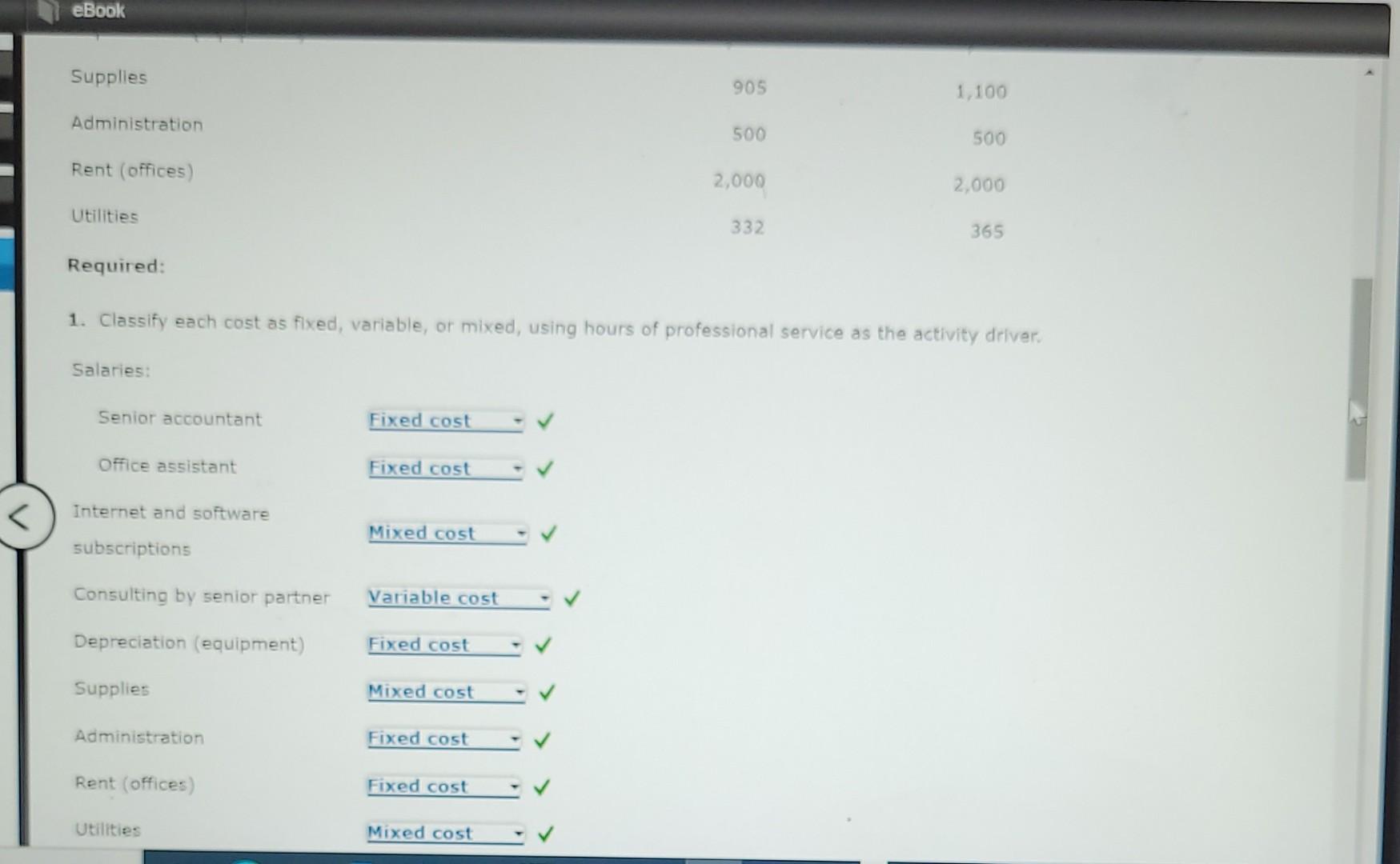

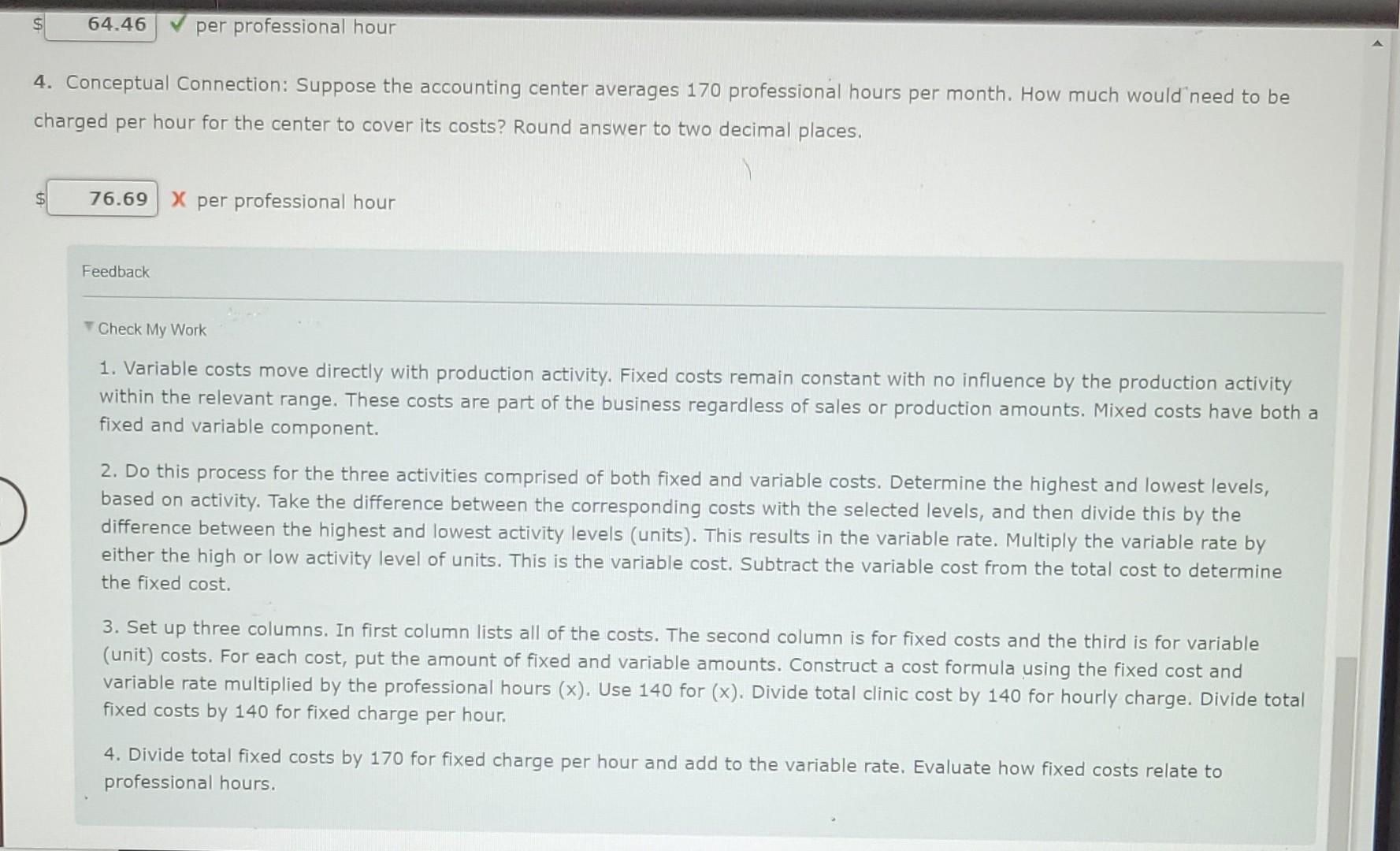

Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firm's founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believes that an inexpensive accounting services clinic could provide basic accounting services for small businesses located in the barrio. He wants to price the services at cost. Since the clinic is brand new, it has no experience to go on. Carlos decided to operate the clinic for 2 months before determining how much to charge per hour on an ongoing basis. As a temporary measure, the clinic adopted an hourly charge of $25, half the amount charged by Fonseca, Ruiz, and Dunn for professional services. The accounting services clinic opened on January 1. During January, the clinic had 120 hours of professional service. During February, the activity was 150 hours. Costs for these two levels of activity usage are as follows: Salaries: Senior accountant Office assistant Internet and software subscriptions Consulting by senior partner Depreciation (equipment) 120 Professional Hours $2,500 1,200 700 1,200 2,400 150 Professional Hours $2,500 1,200 850 1,500 2,400 eBook Supplies Administration Rent (offices) Utilities Required: Salaries: Senior accountant Office assistant Internet and software subscriptions Consulting by senior partner Depreciation (equipment) Supplies 1. Classify each cost as fixed, variable, or mixed, using hours of professional service as the activity driver. Administration Rent (offices) Utilities Fixed cost Fixed cost Mixed cost Variable cost Fixed cost Mixed cost Fixed cost Fixed cost 905 Mixed cost 500 2,000 332 1,100 500 2,000 365 64.46 $ 4. Conceptual Connection: Suppose the accounting center averages 170 professional hours per month. How much would need to be charged per hour for the center to cover its costs? Round answer to two decimal places. per professional hour 76.69 X per professional hour Feedback Check My Work 1. Variable costs move directly with production activity. Fixed costs remain constant with no influence by the production activity within the relevant range. These costs are part of the business regardless of sales or production amounts. Mixed costs have both a fixed and variable component. 2. Do this process for the three activities comprised of both fixed and variable costs. Determine the highest and lowest levels, based on activity. Take the difference between the corresponding costs with the selected levels, and then divide this by the difference between the highest and lowest activity levels (units). This results in the variable rate. Multiply the variable rate by either the high or low activity level of units. This is the variable cost. Subtract the variable cost from the total cost to determine the fixed cost. 3. Set up three columns. In first column lists all of the costs. The second column is for fixed costs and the third is for variable (unit) costs. For each cost, put the amount of fixed and variable amounts. Construct a cost formula using the fixed cost and variable rate multiplied by the professional hours (x). Use 140 for (x). Divide total clinic cost by 140 for hourly charge. Divide total fixed costs by 140 for fixed charge per hour. 4. Divide total fixed costs by 170 for fixed charge per hour and add to the variable rate. Evaluate how fixed costs relate to professional hours

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts