Question: I keep getting $15.6 M for my answer. So, I am not sure if I am doing it wrong or if it is none of

I keep getting $15.6 M for my answer. So, I am not sure if I am doing it wrong or if it is none of the above.

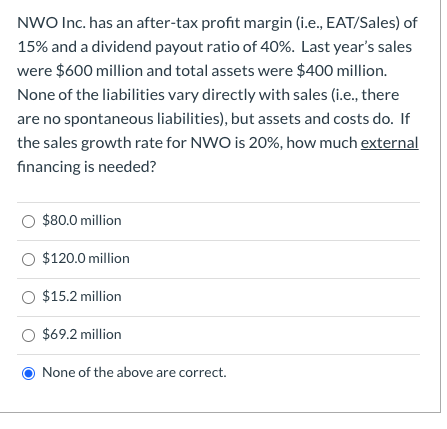

NWO Inc. has an after-tax profit margin (i.e., EAT/Sales) of 15% and a dividend payout ratio of 40%. Last year's sales were $600 million and total assets were $400 million. None of the liabilities vary directly with sales (i.e., there are no spontaneous liabilities), but assets and costs do. If the sales growth rate for NWO is 20%, how much external financing is needed? $80.0 million $120.0 million $15.2 million $69.2 million None of the above are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts