Question: I keep getting 50% and I do not know which ones are wrong. Question 1 of 8 . The IRS is actively auditing and conducting

I keep getting 50% and I do not know which ones are wrong.

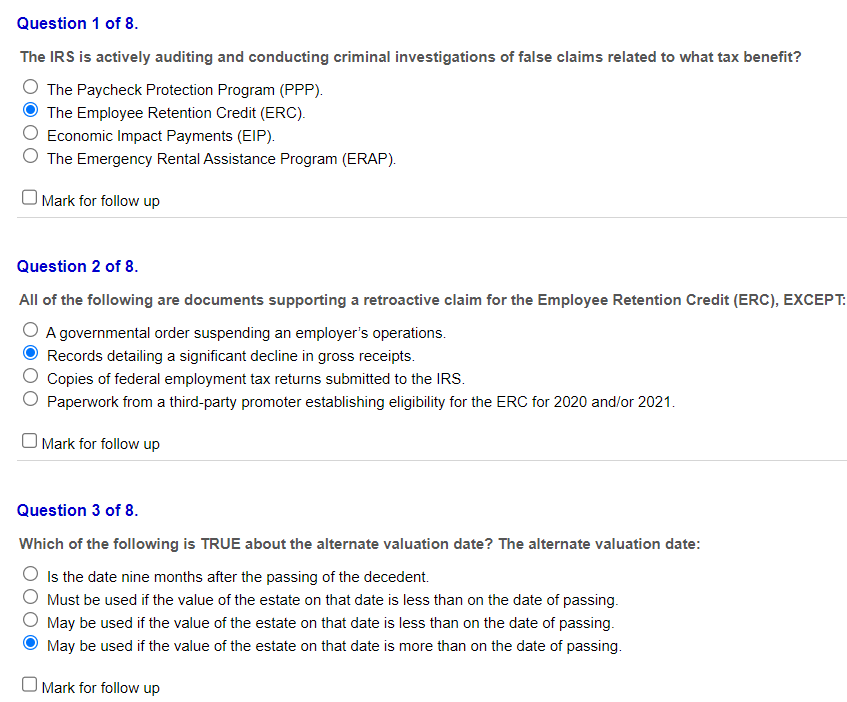

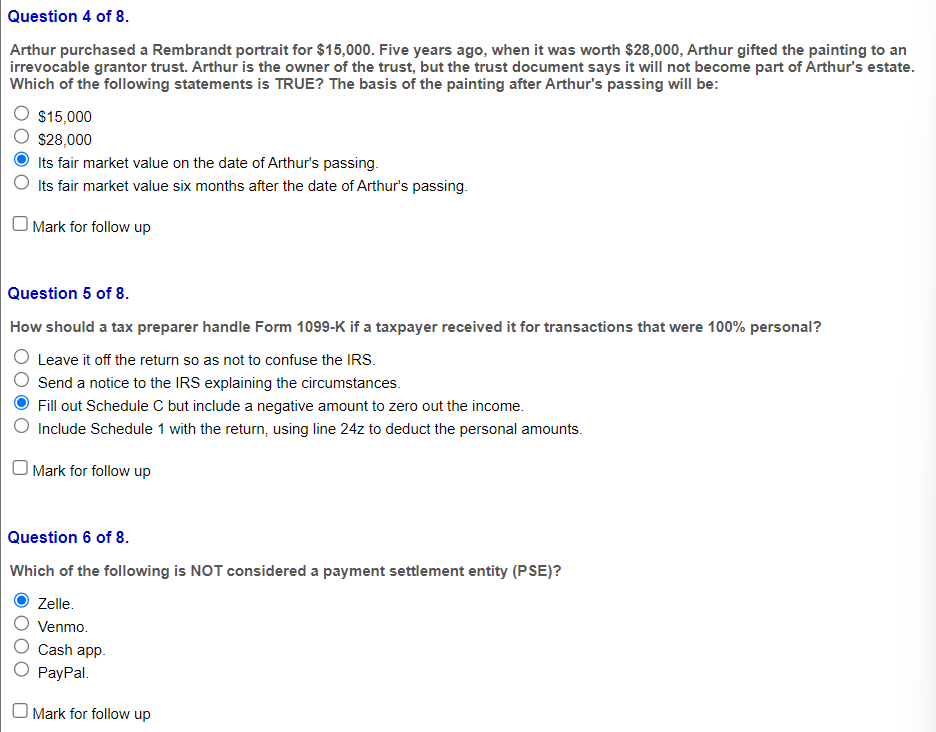

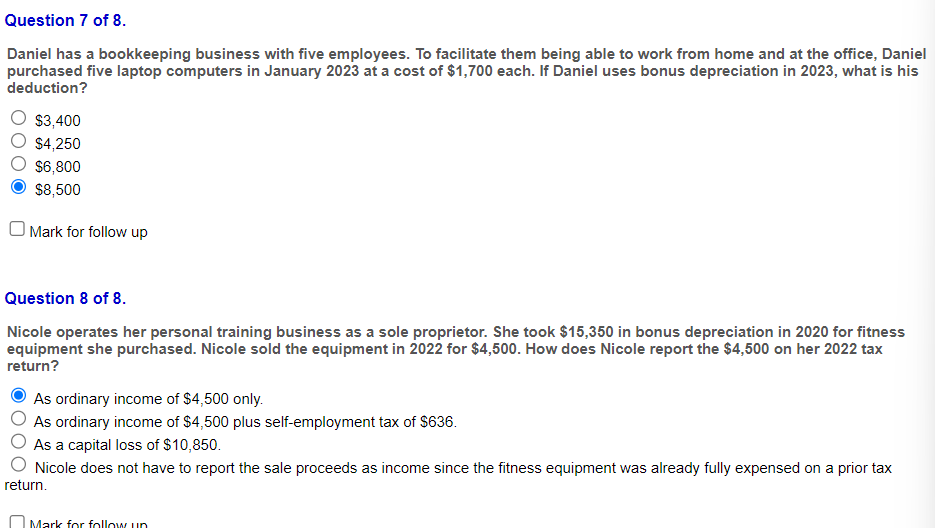

Question 1 of 8 . The IRS is actively auditing and conducting criminal investigations of false claims related to what tax benefit? The Paycheck Protection Program (PPP). The Employee Retention Credit (ERC). Economic Impact Payments (EIP). The Emergency Rental Assistance Program (ERAP). Mark for follow up Question 2 of 8. All of the following are documents supporting a retroactive claim for the Employee Retention Credit (ERC), EXCEPT A governmental order suspending an employer's operations. Records detailing a significant decline in gross receipts. Copies of federal employment tax returns submitted to the IRS. Paperwork from a third-party promoter establishing eligibility for the ERC for 2020 and/or 2021. Mark for follow up Question 3 of 8. Which of the following is TRUE about the alternate valuation date? The alternate valuation date: Is the date nine months after the passing of the decedent. Must be used if the value of the estate on that date is less than on the date of passing. May be used if the value of the estate on that date is less than on the date of passing. May be used if the value of the estate on that date is more than on the date of passing. Mark for follow up Arthur purchased a Rembrandt portrait for $15,000. Five years ago, when it was worth $28,000, Arthur gifted the painting to an irrevocable grantor trust. Arthur is the owner of the trust, but the trust document says it will not become part of Arthur's estate Which of the following statements is TRUE? The basis of the painting after Arthur's passing will be: $15,000$28,000 Its fair market value on the date of Arthur's passing. Its fair market value six months after the date of Arthur's passing. Mark for follow up Question 5 of 8. How should a tax preparer handle Form 1099-K if a taxpayer received it for transactions that were 100% personal? Leave it off the return so as not to confuse the IRS. Send a notice to the IRS explaining the circumstances. Fill out Schedule C but include a negative amount to zero out the income. Include Schedule 1 with the return, using line 24z to deduct the personal amounts. Mark for follow up Question 6 of 8. Which of the following is NOT considered a payment settlement entity (PSE)? Zelle. Venmo. Cash app. PayPal. Mark for follow up Daniel has a bookkeeping business with five employees. To facilitate them being able to work from home and at the office, Daniel purchased five laptop computers in January 2023 at a cost of $1,700 each. If Daniel uses bonus depreciation in 2023, what is his deduction? $3,400 $4,250 $6,800 $8,500 Mark for follow up Question 8 of 8. Nicole operates her personal training business as a sole proprietor. She took $15,350 in bonus depreciation in 2020 for fitness equipment she purchased. Nicole sold the equipment in 2022 for $4,500. How does Nicole report the $4,500 on her 2022 tax return? As ordinary income of $4,500 only. As ordinary income of $4,500 plus self-employment tax of $636. As a capital loss of $10,850. Nicole does not have to report the sale proceeds as income since the fitness equipment was already fully expensed on a prior tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts