Question: I keep getting $8,950, but it's wrong Problem: Module 7 Textbook Problem 6 Learning Objectives: 7-6 Adjust the tax basis in a partnership interest 7.7

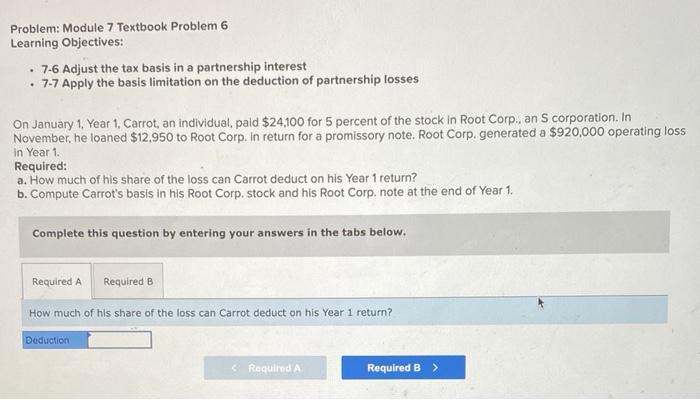

Problem: Module 7 Textbook Problem 6 Learning Objectives: 7-6 Adjust the tax basis in a partnership interest 7.7 Apply the basis limitation on the deduction of partnership losses On January 1, Year 1, Carrot, an individual, pald $24,100 for 5 percent of the stock in Root Corp., an S corporation. In November, he loaned $12,950 to Root Corp. in return for a promissory note. Root Corp. generated a $920,000 operating loss in Year 1. Required: a. How much of his share of the loss can Carrot deduct on his Year 1 return? b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1: Complete this question by entering your answers in the tabs below. Required A Required B How much of his share of the loss can Carrot deduct on his Year 1 retur? Deduction Required A Required B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts