Question: i Keep getting different answers, could you please solve both to make sure im doing this correctly? Thanks! Will leave a thumbs up!! Project Lillian's

i Keep getting different answers, could you please solve both to make sure im doing this correctly? Thanks! Will leave a thumbs up!!

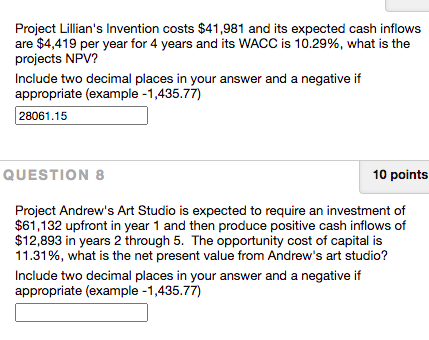

Project Lillian's Invention costs $41,981 and its expected cash inflows are $4,419 per year for 4 years and its WACC is 10.29%, what is the projects NPV? Include two decimal places in your answer and a negative if appropriate (example -1,435.77) 28061.15 QUESTION 8 10 points Project Andrew's Art Studio is expected to require an investment of $61,132 upfront in year 1 and then produce positive cash inflows of $12,893 in years 2 through 5. The opportunity cost of capital is 11.31%, what is the net present value from Andrew's art studio? Include two decimal places in your answer and a negative if appropriate (example -1,435.77)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts