Question: i keep getting part c wrong a. Given an interest rate of 11% calculate the present value of the sales price of the store at

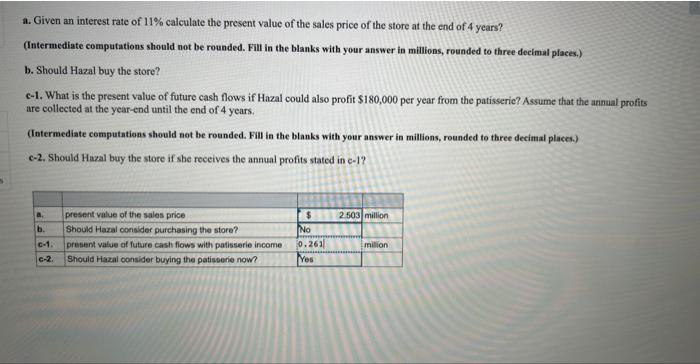

a. Given an interest rate of 11% calculate the present value of the sales price of the store at the end of 4 years? (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal places,) b. Should Hazal buy the store? c-1. What is the present value of future cash flows if Hazal could also profit $180,000 per year from the patisserie? Assume that the annual profits are collected at the year-end until the end of 4 years. (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal place.) c-2. Should Hazal buy the store if she receives the annual profits stated in c-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts