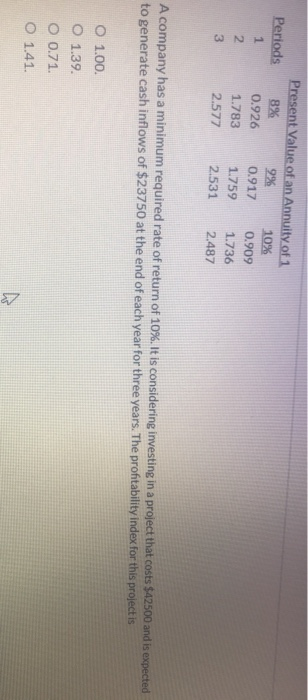

Question: I keep getting them wrong :( please help! Periods 1 Present Value of an Annuity of 1 8% 9% 10% 0.926 0.917 0.909 1.783 1.759

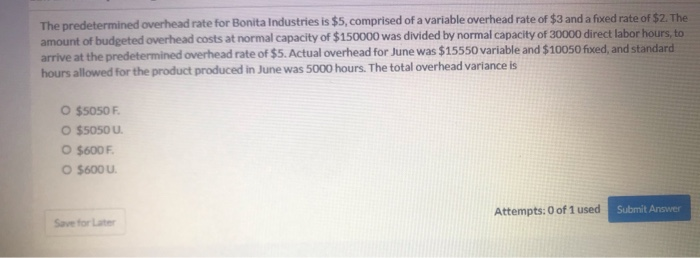

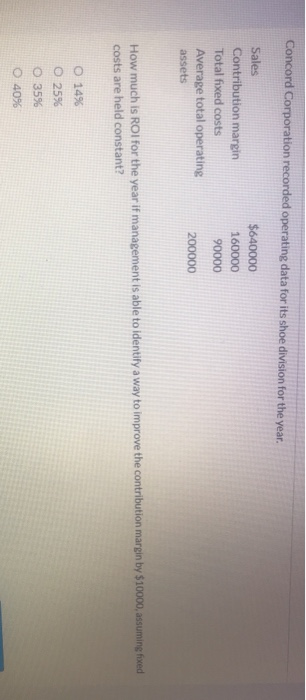

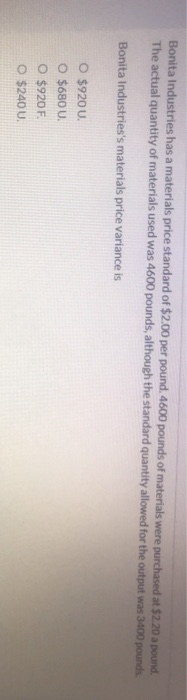

Periods 1 Present Value of an Annuity of 1 8% 9% 10% 0.926 0.917 0.909 1.783 1.759 1.736 2.577 2.531 2.487 2 3 A company has a minimum required rate of return of 10%. It is considering investing in a project that costs $42500 and is expected to generate cash inflows of $23750 at the end of each year for three years. The profitability index for this project is O 1.00 O 1.39. O 0.71. O 1.41 N The predetermined overhead rate for Bonita Industries is $5, comprised of a variable overhead rate of $3 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $150000 was divided by normal capacity of 30000 direct labor hours, to arrive at the predetermined overhead rate of $5. Actual overhead for June was $15550 variable and $10050 fixed, and standard hours allowed for the product produced in June was 5000 hours. The total overhead variance is O $5050 F 09050 0. O $600 F $600 U. Attempts: 0 of 1 used Submit Answer Save for Later Concord Corporation recorded operating data for its shoe division for the year. Sales Contribution margin Total fixed costs Average total operating assets $640000 160000 90000 200000 How much is ROI for the year if management is able to identify a way to improve the contribution margin by $10000, assuming fixed costs are held constant? O 14% 0 25% 3596 4096 Bonita Industries has a materials price standard of $2.00 per pound. 4600 pounds of materials were purchased at $2.20 a pound. The actual quantity of materials used was 4600 pounds, although the standard quantity allowed for the output was 3400 pounds Bonita Industries's materials price variance is 0 $9200 O $680U. O $920 F. $240 U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts