Question: I keep getting this incorrect, please help me answer them correctly. Drop down for levered beta (b) (1.69 / 1.47 / 1.18 / 1.76) Drop

I keep getting this incorrect, please help me answer them correctly.

I keep getting this incorrect, please help me answer them correctly.

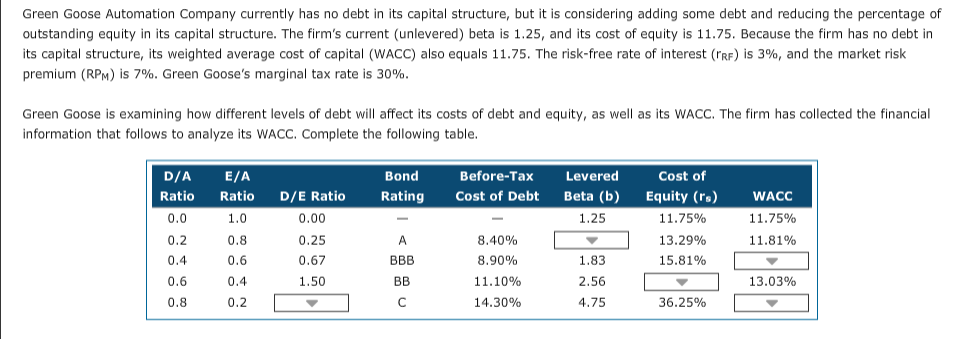

Drop down for "levered beta (b) (1.69 / 1.47 / 1.18 / 1.76)

Drop down for "WACC" (13.78% / 14.98% / 11.98% / 12.58)

Drop down for "Cost of Equity (rs)" (24.06% / 23.01% / 17.78% / 20.92%)

Drop down for "D/E ratio" (4.00 / 3.60 / 4.40 / 3.20)

Drop down for bottom row "WACC" is (13.73% / 15.26% / 14.50% / 12.21%)

If correct, I will make sure to thumbs up, thank you!

Green Goose Automation Company currently has no debt in its capital structure, but it is considering adding some debt and reducing the percentage of outstanding equity in its capital structure. The firm's current (unlevered) beta is 1.25, and its cost of equity is 11.75. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 11.75. The risk-free rate of interest (rRF) s3%, and the market risk premium (RPM) is 7%. Green Goose's marginal tax rate is 30% Green Goose is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its WACC. Complete the following table Cost of Equity (rs) 11.75% 13.29% 15.81% D/A E/A Bond Before-Tax Levered Beta (b) 1.25 Ratio Ratio 1.0 0.8 0.6 0.4 0.2 D/E Ratio 0.00 0.25 0.67 1.50 RatingCost of Debt WACC 11.75% 11.81% 0.0 0.2 0.4 0.6 0.8 8.40% 8.90% 11.10% 14.30% 1.83 2.56 4.75 13.03% 36.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts