Question: I keep getting this question wrong, please help! Presented below is selected information for Wildhorse Company. Answer the questions asked about each of the situations.

I keep getting this question wrong, please help!

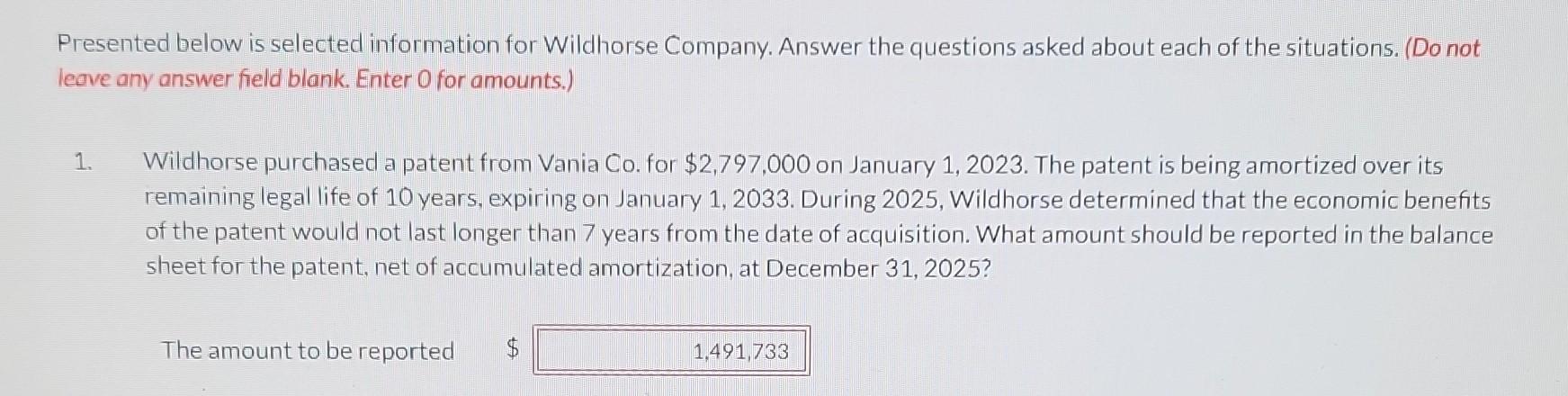

Presented below is selected information for Wildhorse Company. Answer the questions asked about each of the situations. (Do not leove any answer field blank. Enter 0 for amounts.) 1. Wildhorse purchased a patent from Vania Co. for $2,797,000 on January 1,2023 . The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2033. During 2025, Wildhorse determined that the economic benefits of the patent would not last longer than 7 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31,2025 ? The amount to be reported $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts