Question: I keep getting wrong answer for the general in Year 1 if someone can help me out with this. Not sure what I am doing

I keep getting wrong answer for the general in Year 1 if someone can help me out with this. Not sure what I am doing wrong here. Thank you!

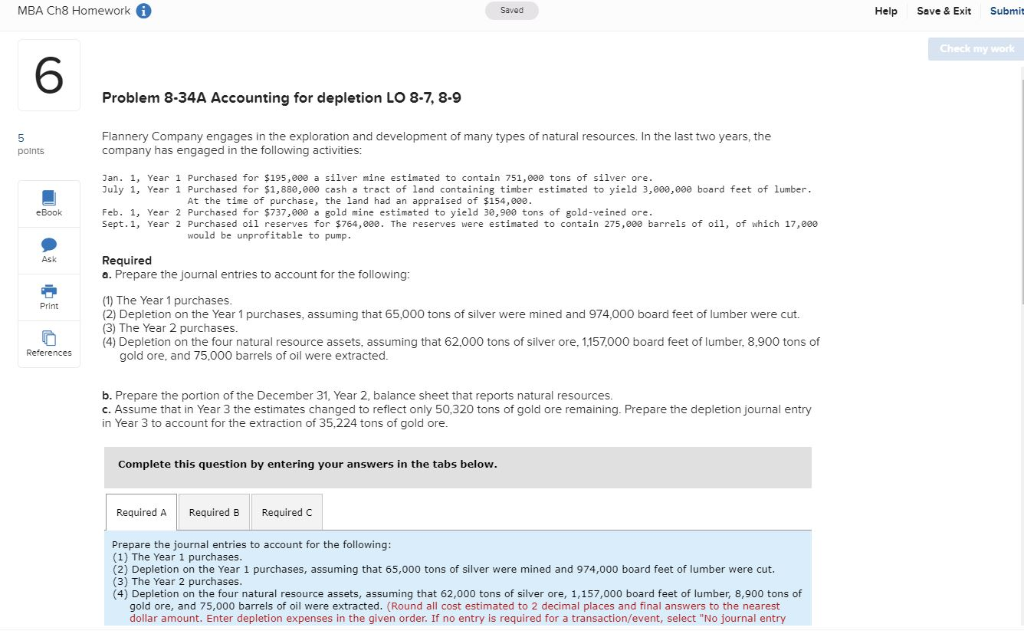

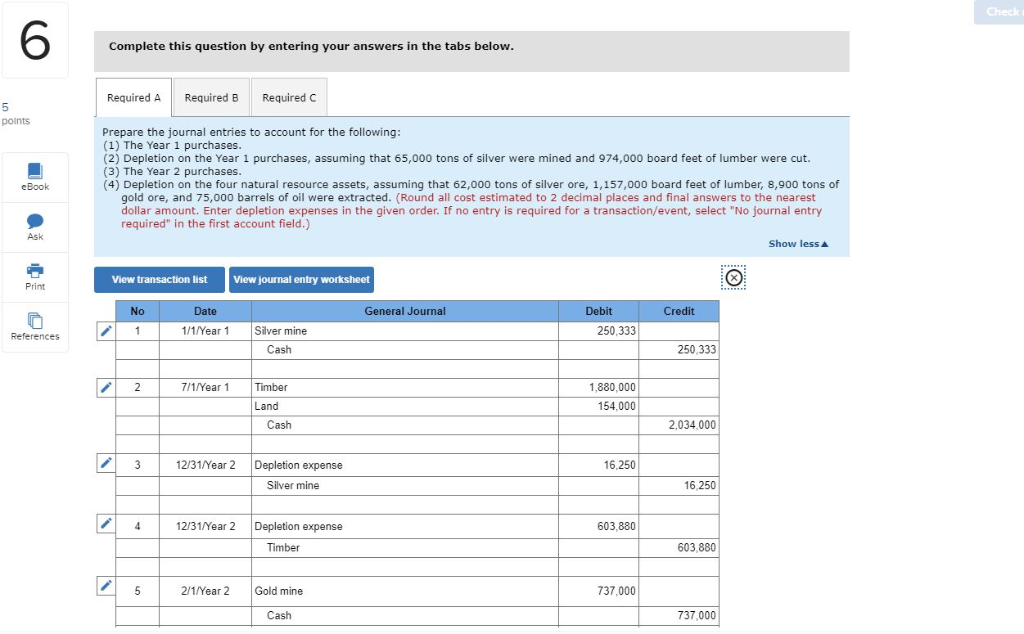

MBA Ch8 Homework Saved Help Save & Exit Submit Check my work Problem 8-34A Accounting for depletion LO 8-7, 8-9 Flannery Company engages company has engaged in the following activities: the exploration and development of many types of natural resources. In the last two years, the 5 points Purchased for $1.880.000 cash a tract of land containing timber estimated to vield 3.000.000 board feet of lumber. At the time of purchase, the land had an appraised of $154,00e. Purchased for $737,e00 gold 1ne estmeted to y1eld 30,960 tons or B barrels of oil, of which 17,e00 July 1, Yean eBook Feb. 1, Year Sep Year reserves were would be unprofitable to pump. Ask Required a. Prepare the journal entries to account for the following: (1) The Year 1 purchases. (2) Depletion on the Year 1 purchases, assuming that 65,000 tons of silver were mined and 974,000 board feet of lumber were cut. (3) The Year 2 purchases (4) Depletion on the four natural resource assets, assuming that 62,000 tons of silver ore, 1,157,000 board feet of lumber, 8,900 tons of gold ore, and 75,000 barrels of oil were extracted. Print Re rences b. Prepare the portion of the December 31, Year 2, balance sheet that reports natural resources. c. Assume that in Year 3 the estimates changed to reflect only 50,320 tons of gold ore remaining. Prepare the depletion journal entry in Year 3 to account for the extraction of 35,224 tons of gold ore. the tabs below. Complete this question by entering your answers Required A Required B Required C Prepare the journal entries to account for the following: (2) Depletion on the Year 1 purchases, assuming that 65,000 tons of silver were mined and 974,000 board feet of lumber were cut. (3) The Year 2 purchases (4) Depletion on the four natural resource assets, assuming that 62,000 tons of silver ore, 1,157,000 board feet of lumber, 8,900 tons of the tre dollar amount Enter depletion expenses in the given order Complete this question by entering your answers in the tabs below. Required B Required A Required C 5 points Prepare the journal entries to account for the following: (2) Depletion on the Year 1 purchases, assuming that 65,000 tons of silver were mined and 974,000 board feet of lumber were cut. (3) The Year 2 purchases. (4) Depletion on the four natural resource assets, assuming that 62,000 tons gold ore, and 75,000 barrels of oil were extracted. (Round all cost estimated to 2 decimal places and final answers to the nearest silver ore, 1,157,000 board feet of lumber, 8,900 tons of eBook dollar amou e eple eld ses in the given order. If no entry is required for a transaction/event, select "No journal entry required" the first account Ask Show less View transaction list View journal entry worksheet Print No Date General Journal Debit Credit Silver mine 1/1/Year 1 250,333 1 References Cash 250,333 2 7/1/Year 1 Timber 1,880,000 Land 154.000 Cash 2,034,000 3 12/31/Year 2 Depletion expense 16.250 Silver mine 16.250 12/31/Year 2 603.880 4 Depletion expense 603.880 Timber Gold mine 5 2/1/Year 2 737,000 Cash 737.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts