Question: I know for part b the entry is: Bonds Payable 400,000 Premium on Bonds Payable 6,400 Common Stock 320,000 Paid-in Excess of Par Common Stock

I know for part b the entry is:

| Bonds Payable | 400,000 | |

| Premium on Bonds Payable | 6,400 | |

| Common Stock | 320,000 | |

| Paid-in Excess of Par Common Stock | 86,400 |

I know for part c the entries are:

| Interest Expense | 7800 | |

| Premium on Bonds Payable | 200 | |

| Interest Payable | 800 |

| Bonds Payable | 400,000 | |

| Premium on Bonds Payable | 6200 | |

| Common Stock | 320,000 | |

| Paid-in Capital in Excess of Par Common Stock | 86,200 |

*Conceptual question*

It was explained that the Premium on Bonds Payable for the first entry for part c was calculated by first taking 57,600 (the unamortized portion as of March 31, 2022) and dividing it by 16 because 16 periods left. The calculation was as follows: (57,600/16) * (400,000/3,600,000) * (3/6) = 200. Is it being multiplied by 3/6 because it's been 3 months since December 31, 2021, which would have been the last amortization date? Or is it being multiplied by 3/6 because it's been 3 months since January 1, 2022, which was the last time the premium on bonds payable account was debited? In other words, is the 3 months based off the last amortization date of December 31, or is the 3 months starting from the last time the premium on bonds payable account was debited? Please explain why.

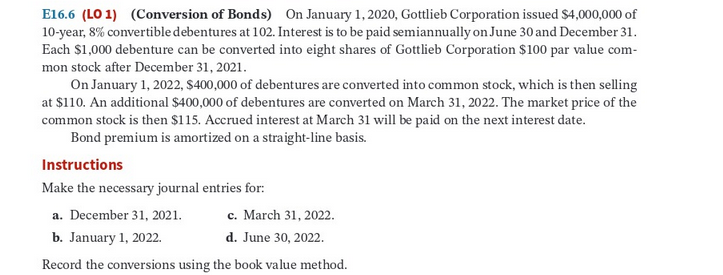

E16.6 (LO 1) (Conversion of Bonds) On January 1, 2020, Gottlieb Corporation issued $4,000,000 of 10-year, 8% convertible debentures at 102. Interest is to be paid semiannually on June 30 and December 31. Each $1,000 debenture can be converted into eight shares of Gottlieb Corporation $100 par value com- mon stock after December 31, 2021. On January 1, 2022, $400,000 of debentures are converted into common stock, which is then selling at $110. An additional $400,000 of debentures are converted on March 31, 2022. The market price of the common stock is then $115. Accrued interest at March 31 will be paid on the next interest date. Bond premium is amortized on a straight-line basis. Instructions Make the necessary journal entries for: a. December 31, 2021. c. March 31, 2022 b. January 1, 2022. d. June 30, 2022 Record the conversions using the book value method. E16.6 (LO 1) (Conversion of Bonds) On January 1, 2020, Gottlieb Corporation issued $4,000,000 of 10-year, 8% convertible debentures at 102. Interest is to be paid semiannually on June 30 and December 31. Each $1,000 debenture can be converted into eight shares of Gottlieb Corporation $100 par value com- mon stock after December 31, 2021. On January 1, 2022, $400,000 of debentures are converted into common stock, which is then selling at $110. An additional $400,000 of debentures are converted on March 31, 2022. The market price of the common stock is then $115. Accrued interest at March 31 will be paid on the next interest date. Bond premium is amortized on a straight-line basis. Instructions Make the necessary journal entries for: a. December 31, 2021. c. March 31, 2022 b. January 1, 2022. d. June 30, 2022 Record the conversions using the book value method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts